- Crypto Uncomplicated

- Posts

- What's driving ethereum's 50% weekly surge?

What's driving ethereum's 50% weekly surge?

Could a long-planned ethereum upgrade actually finally be happening?

Crypto Uncomplicated is a free crypto newsletter distilling all the happenings in the crypto space. Unlock the full experience as a premium subscriber by signing up here. Last week, premium subscribers got a closer look at Polygon, the ethereum scaling chain that's surging on partnerships with Reddit and Coinbase.

As the last few Crypto Uncomplicated newsletters have highlighted, a cascade of implosions at decentralized and centralized lenders has dragged prices lower. Fear is rampant, and no one really knows whether the dominoes are done falling.

And yet, ethereum is up nearly 50% in the last week. It's a bit of a head scratcher. Especially since we learned even more about the extent to which the bust of crypto fund Three Arrows Capital has rippled through the space.

Ethereum is up by about 50% over the last week. That's notably higher than bitcoin's 20% rally over the same stretch.

A bankruptcy filing first highlighted by The Block on Monday showed that lender Genesis had loaned Three Arrows Capital a whopping $2.36 billion. (Keep in mind, Genesis also helps enable the 8% interest that the "crypto bank" Gemini pays out.)

So, if it's true that fear and forced selling by lenders backed into a corner by the now bankrupt Three Arrows Capital sparked ethereum's 50% drop from $2,000 to $1,000, it's hard to see why anything in that storyline would cause a 50% rally. Especially if nothing has really categorically changed. So what did?

Well, there are planned upgrades to the ethereum network that have been planned for quite some time. And it's starting to look like things might be happening soon... ish.

It's called "the merge" and basically it's the largest-ever software upgrade in ethereum's history. It involves shifting the network from proof-of-work (the energy-intensive mechanism that bitcoin employs to secure its network) to proof-of-stake (the less energy-intensive alternative that's 99% more efficient.) The upgrade also stands to make it so a portion of ether used in transactions is permanently burned, which would make ether deflationary (more coins being burnt than created.) All in all, people have been stoked for it, because it would be hugely bullish.

As CoinDesk recently covered, some analysts have compared it to being roughly equivalent to three bitcoin "halvings" -- the programmed 50% cuts to the rewards bitcoin miners receive when confirming a block of transactions on the network that happens every four years (review all that in my prior post here.)

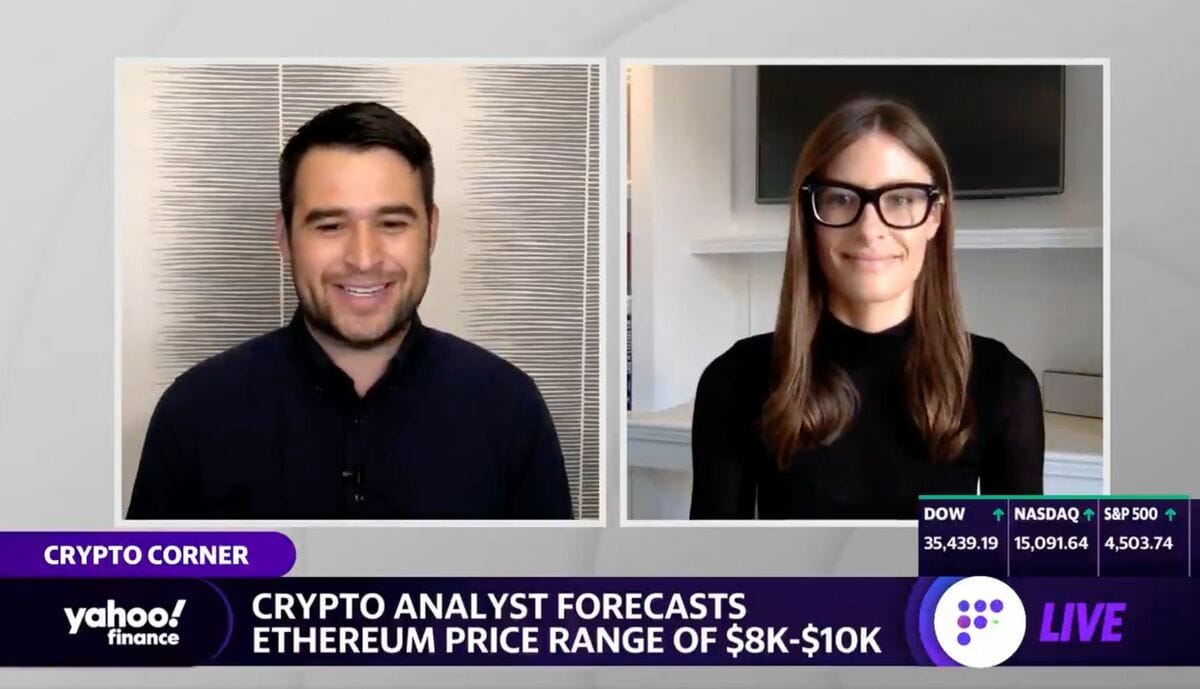

To put it in context further, in an interview with Magnetic Director Megan Kaspar last year, I asked her about the impact of the merge and she told me that if it went into effect last year, as planned, it could have pushed ethereum's price into a range of $8,000 to $10,000. Last November, however, the Ethereum Foundation pushed back the implementation of the network upgrade to a new proposal of mid-2022. And then, for the sixth time since talk of "the merge" began, the timeline was delayed again earlier this year. Oof.

Magnetic Director Megan Kaspar had correctly called two price rallies in 2021. A third call for ether to hit a range of $8,000 - $10,000 hinged on ethereum's "merge" happening in 2021, which did not pan out.

But late last week, something different happened. And more people may have bought into this time being different. The very same Ethereum Foundation member (Tim Beiko) who had previously broken the bad news, instead, gave some good news: it could happen as soon as September 19.

Now, obviously, this cycle of optimism and disappointment has happened multiple times with each merge delay, and even as Beiko warned, delays could strike again. Then again, either way, the merge is still coming eventually. For long-term investors, the fact that it hasn't happened yet may have served as reason to hold on through the selloff.

Increasingly, as I wrote about last week, determining prices in the next couple of months will continue to be a fool's errand. The overhang of crypto bankruptcies isn't over. The overhang of inflation and the shock to the Fed reacting to get inflation under control might be waning. But technological upgrades like ethereum's merge are important things to be aware of when we zoom out. And maybe, just maybe, some of that long-term belief is starting to take hold in prices stabilizing now.

Crypto Uncomplicated is a free crypto newsletter distilling all the happenings in the crypto space. Get exclusive, expert insights on how to play the increased volatility as a premium subscriber by signing up here.