- Crypto Uncomplicated

- Posts

- After a record $40 billion implosion, Terra plans a rise from the ashes

After a record $40 billion implosion, Terra plans a rise from the ashes

To "rise up anew from the ashes" is relative

If you're just joining us, the last two weeks have felt like years for one of crypto's once hottest projects. In a matter of days, the former belle of the crypto ball Terra saw its more than $40 billion in value go kaput in what was an unprecedented crypto bank run.

For some, Terra's collapse was inevitable. It was only a matter of time before it would join the other projects that all failed before trying to accomplish the same thing: Prop up a digital dollar stablecoin with nothing more than code and faith that it would work. (Hint: It didn't work.)

What's more frustrating for retail traders who invested their life savings into a (seemingly stable) project that was marketing a 20% interest rate, is the fact that many more sophisticated traders and hedge funds got out right before the collapse came. As the New York Times recently documented, one early Terra backer, Pantera Capital, turned $1.7 million into $170 million over the span of a single year.

Former hedge fund manager and CEO of Galaxy Digital Mike Novogratz, famous for investing in Terra's LUNA token when it was trading at $2 and later getting a tattoo of it on his arm when it crossed $100, also quietly put out an investor letter noting Galaxy Digital had been taking profits on LUNA as it appreciated. (Interestingly, Novogratz was still also hyping up LUNA just a few weeks ago during his opening keynote at the Bitcoin Conference in Miami.)

Now, of course, there's nothing wrong with people taking profits while investing. But when those people are some of the richest, and their wins are juxtaposed with the backdrop of a bunch of retail traders who lost so much that they are considering suicide, it's a real tough look.

That's what makes Terra's recovery plan all that more important. It's also why people desperately want to believe Terra founder Do Kwon's plan to have Terra, in his words, "rise up anew from the ashes."

Paid subscribers got a preview of what the team behind Terra is attempting to pull off last week. As I covered, it's a bit of a Hail Mary that seeks to airdrop, or gift, tokens of a completely new blockchain to those that were holders of tokens of the old one. It's not without precedent, as the team behind Ethereum also basically rolled back time to before their network was exploited back in 2016. (Upgrade to a premium subscription here.)

Importantly, Terra's plan is a bit different. It's not just one transaction or exploit they are trying to undo. They are trying to undo all of the collapse by rolling out a new blockchain, albeit one that's quite neutered from what it was before. The new blockchain will basically just be an ethereum competitor that's completely devoid of any of the UST stablecoin element that catapulted Terra into a top-10 crypto project by market cap. Pro: it keeps all the developers who originally came to build on Terra, on Terra, rather than jumping ship to another chain. Con: A lot of the reason why people wanted to build on Terra and why it was so hot in the first place was that it had UST, the strongest case for a decentralized, digital dollar coin. In any case, as I recapped, Terra's plan is to compensate both LUNA holders and UST holders with new tokens:

LUNA holders were essentially equity holders that were more open to taking on the risk of volatile moves for larger upside. UST holders, on the other hand, were essentially debt holders who just wanted their UST to stay at $1 and were perfectly content earning a 20% yield. Now, Terra is planning to roll back time to before UST's stablecoin broke from the $1 value it was supposed to hold. Holders on record at that time would get an allocation of 1,000,000,000 new LUNA tokens, and the old chain would be rebranded as Terra Classic (with those tokens being rebranded to LUNC.)You can read Do Kwon's full proposal on Terra's Agora community forum, but it essentially takes the tough task of getting down to divvying up a share of a less robust network. Almost assuredly, that's not going to make anyone whole. But it may be better than nothing.

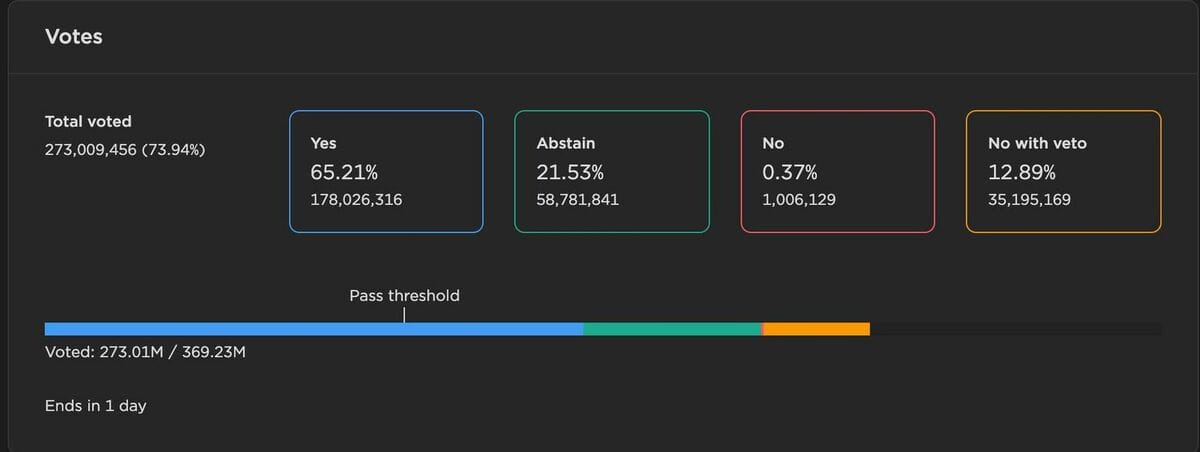

At the time of writing this, Terra's plan was overwhelmingly set to pass its community vote so long as the remaining vote doesn't veto it. That means all systems look like a go for Terra to create this new blockchain.

The vote tally for Terra's proposed plan to form a new chain had majority support with just one day of voting to go on its community forum. (Source: Terra Station Screenshot.)

What will be extremely interesting to watch is how this is all handled by the exchanges that previously listed LUNA and UST. They kind of have blood on their hands a bit in all of this for failing to disclose to customers the risks of the UST stablecoin breaking its $1 peg. In fact, crypto exchange KuCoin is already marketing to customers a potential 60% interest they could earn on another algorithmically-backed stablecoin, USDD, which looks eerily similar to UST.

The CEO of Binance, the largest crypto exchange in the world, has been extremely critical of the way Terra has handled plans to salvage things in the aftermath of its collapse. It will be interesting to see if he plays along in listing the new tokens, or how they distribute any of the new airdropped tokens to impacted customers. There are already lawyers working on class action lawsuits against any of the exchanges who failed to appropriately disclose risks around Terra to customers. I suspect making users whole (or at least supporting an airdrop that is attempting to) in the wake of all this becomes somewhat of a more important priority for them.

Crypto Uncomplicated is a free crypto newsletter distilling all the happenings in the crypto space. Unlock the full experience as a premium subscriber by signing up here.

Disclosure: BTC, LUNA, and UST are all among the author's holdings.