- Crypto Uncomplicated

- Posts

- Bitcoin's price is flat in 2022, so what has this crypto surging 70%?

Bitcoin's price is flat in 2022, so what has this crypto surging 70%?

Thorchain is the biggest crypto winner so far this year

Perhaps the most exciting aspect of today's crypto market is that not all coins move in lockstep.

It's no longer the case that if bitcoin is down, all else must follow. In fact, the market has matured to a point to where individual crypto projects delivering on their individual missions can actually appreciate even on down market days.

That theory has been proven out so far this year by the decentralized exchange known as Thorchain. The cryptocurrency powering its technology has surged more than 70% all while bitcoin has mostly traded sideways.

Let's dig into why.

What is Thorchain?

For starters, let's appreciate the environment we're in. There has been a lot of talk about crypto regulation. (Duh Zack, ain't there always?) Yes, it's a common talking point. But, particularly with the back and forth around the Russia-Ukraine conflict and what it means for policing exchanges, a new-found importance has been placed on censorship-resistant exchanges. That is, ones that aren't susceptible to being shut down.

At its core, Thorchain enables truly decentralized swaps across chains -- without wrapping tokens and without intermediaries. That means, it allows for native swaps of bitcoin to ethereum (and plenty of other chains) without having to go through any centralized party to do so.

Why is that huge?

For people looking to have a way to swap crypto without having to first identify themselves, Thorchain introduces an interesting alternative to centralized exchanges like Coinbase or FTX. Conversely, it also presents an interesting option for exchanges who don't want to comply with Know Your Customer or Anti-Money Laundering rules.

For example, ShapeShift (founded by early bitcoin advocate Erik Vorhees) opted to implement Thorchain's technology to handle their customers' swaps last year. By doing so, they rid themselves of having to comply with KYC or AML rules because they were no longer handling any transactions themselves. (You can read Vorhees' explainer on Thorchain here.)

The more obvious reason why Thorchain is huge is that it allows individuals to earn yield on their crypto assets. Much like the way a bank pays you interest on your deposits for allowing them to make loans with your liquidity, Thorchain will pay liquidity providers rewards for allowing the protocol to power its own swaps.

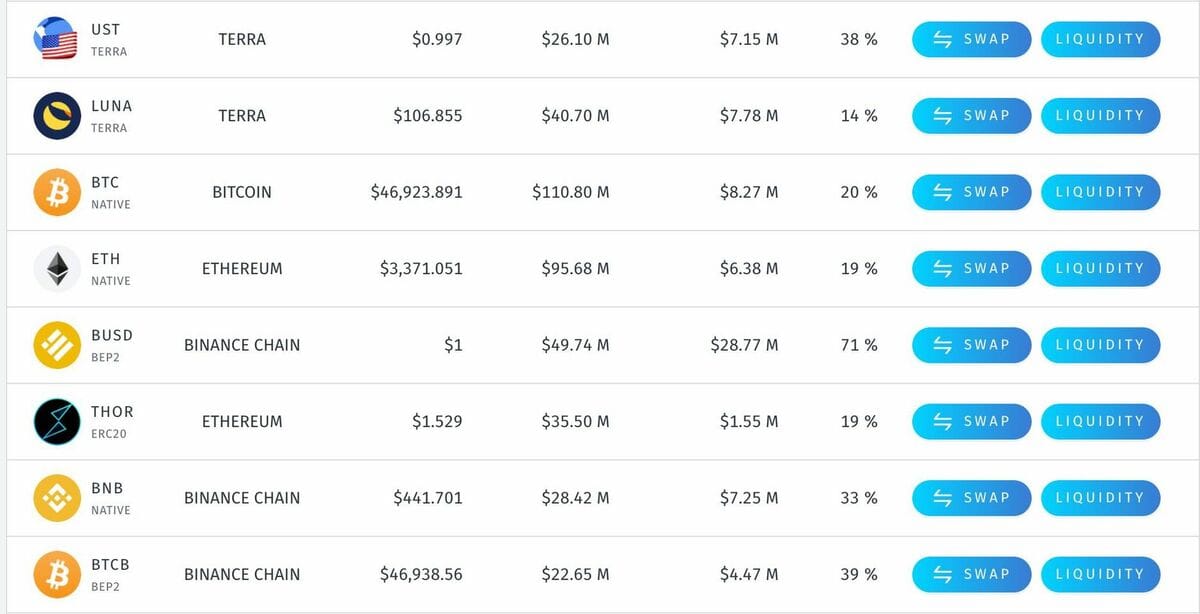

In fact, right now, for providing liquidity, you could earn 38% on the stablecoin UST, 19% on ethereum, or 20% interest on bitcoin. That compares quite favorably to the 5% and 4.5% interest that centralized lending platform BlockFi pays on ETH and BTC, respectively.

So what's the catch? Well, let's chat about that APY.

Advertised APY's listed in the far right column show yield you could earn on major cryptocurrencies. (Sourced from: https://app.thorswap.finance)

In order to power the swaps across chains that don't have a native way to pass information to each other, Thorchain utilizes its own cryptocurrency called "Rune." Each liquidity pool on Thorchain is therefore a combined pool of Rune and another cryptocurrency. (Lead developer Chad Barraford walked me through all this on Yahoo Finance last year.)

When users come to deposit into the main platform built on Thorchain, they can either add crypto from one side of the pair (just bitcoin, for example) or both sides (adding Rune and bitcoin, for example.) Adding to a given pool entitles a liquidity provider to a certain share of fees generated by that pool whenever someone swaps between them on Thorchain. In other words, instead of someone trading on Coinbase and having their trading fee go to Coinbase, swap fees go back to Thorchain liquidity providers.

That also means, however, that the juicy APYs you see presented as if they are a perfect apples-to-apples comparison to what you could be getting at a BlockFi or a bank is not exactly correct. The "interest" you are earning in swap fees paid to the pools are not paid in stablecoins or dollars, of course, but rather in a mix of Rune and the asset its paired with in the pool. That means your APY is directly impacted by the swings in the price of Rune. (Indeed there are ways to hedge against that risk, like shorting Rune, as well.)

Is it like the other decentralized exchanges?

There are other decentralized exchanges that operate with a similar liquidity pool model (Uniswap and SushiSwap are a couple.) However, Thorchain is unique in that it does not use wrapped tokens (like wrapped bitcoin) that are backed up by centralized crypto institutions. In effect, wrapped bitcoin acts like a digital IOU for bitcoin on other chains (like ethereum) but are not actual bitcoin. In theory, that could pose a potential problem if that centralized institution runs into issues honoring wrapped tokens.

By using its own token, Thorchain has sidestepped the need to use wrapped tokens and lean on a trusted intermediary. That also means Rune has the potential to appreciate in price as Thorchain's liquidity continues to grow. As more people have focused on the upside of Thorchain's offering this year, the total value locked -- a measure of all assets on the platform -- has more than doubled from about $200 million to more than $500 million.

Total Value Locked on Thorchain has more than doubled in the last six months. (Source: DeFi Llama.)

What are the risks?

In the decentralized exchange space, there is always a list of risks to highlight. Thorchain holders (myself included) learned that first-hand in 2021 when Thorchain suffered a series of exploits in which millions were drained from the platform. Luckily, Thorchain had limited the amount of money users could contribute to the platform, which meant the overall loss was somewhat mitigated. Thorchain's treasury was also able to cover the full amount stolen, so no liquidity providers were impacted.

Needless to say, however, that hack severely impacted the trust people had in the network and lead to a substantial contraction in liquidity. The price of Rune suffered as it went on to fall farther from a high of around $20 a coin down to just below $4.

Since then, the chain has gone through extensive audits and the former exploits have been patched. Of course, that doesn't mean new exploits or issues can't arise in the future.

What is next for Thorchain?

Thorchain's return to the limelight was prompted by quite a bit more than just an appreciation for decentralized exchanges. The platform recently added swaps for Terra and its stablecoin UST. (You can read my prior post on Terra here.) Perhaps it's not a surprise to point out that almost any time Thorchain adds support for a new native chain, we see a surge in liquidity on the platform. And, usually, that spells short-term support for Rune's price as well. There are still a lot of chains to add.

On top of that, Thorchain wants to work on building out more simple to use savings and lending options for users. I suspect that will be huge when it comes.

In summary, the bet on Rune is a simple one: So long as liquidity on the platform continues to grow, the crypto's price should continue its march higher. So far, that trend is intact and as regulators ramp up their crackdowns on centralized institutions like BlockFi, more and more crypto holders might seek to earn yield on their assets through protocols like Thorchain.

What do you think? Let me know in the comments or email me back to ask more questions! Thanks for subscribing!

Disclosure: Thorchain has been a personal holding of mine since 2021.