- Crypto Uncomplicated

- Posts

- The company behind the largest bitcoin fund just sued the SEC

The company behind the largest bitcoin fund just sued the SEC

When the SEC turns your ETF application down yet again, you can always turn the tables

It's 2022. You can buy bitcoin pretty easily on any exchange.

But for financial institutions or institutional investors who can't invest directly into crypto, there has always been a need for financial products that make it legal or far easier for them to do so. Even for you, it might be easier from a tax perspective to buy or sell it in more advantageous ways.

One of those ways has been Grayscale's Bitcoin Trust, or GBTC, which has been around since 2013 for accredited investors before it launched to trade publicly in 2015. It was the first major, publicly available way for people to access exposure to bitcoin without having to hold the crypto directly. It quickly exploded in size and popularity and now controls over $13 billion in assets.

And yet, as large as that sounds, it would likely be larger if Grayscale could make it even simpler. That's because unlike simple ETFs, or exchange traded funds, which are really just baskets of assets (most commonly stocks,) GBTC is instead a trust. And unlike an ETF, GBTC has no redemption mechanism, meaning that shares in the trust can neither be created nor destroyed as demand from investors shifts.

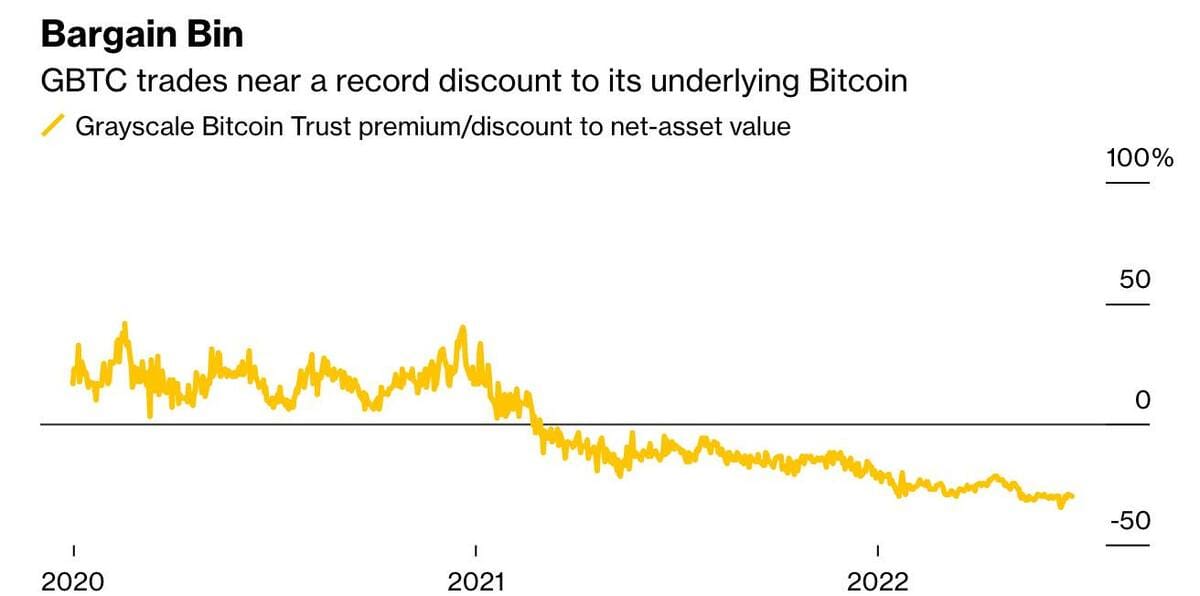

Right now, demand for bitcoin ain't all that hot given the collapse of major crypto institutions, so GBTC is actually trading at a discount relative to the total bitcoin the trust controls. Intuitively, that makes sense, because when demand is high and everyone wants exposure to bitcoin, institutions would be more willing to pay a premium on GBTC shares to get in on the party if they can't outright buy bitcoin themselves.

When bitcoin is performing well, GBTC has historically seen shares trade at a premium to spot prices. But shares are now close to trading at a 30% discount. (Source: Bloomberg chart; screenshot)

For managing all this, Grayscale charges a pretty hefty 2% fee. On $13 billion, that's about $230 million a year in fees. Not too shabby, especially considering the fact that ETFs normally only charge fees below 0.9%.

So, at this point you might be wondering, "Why would Grayscale want to convert their trust into an ETF then?" Well, if doing so boosts the number of people who can trade your product, it's still a net-positive if you can charge more people even a lower fee. Not to mention, if anyone can say they are the first Bitcoin ETF to win approval from the SEC, that's huge in attracting massive capital (basically, corner the market, collect all the fees.)

Then again, everyone and their mom has been petitioning the SEC to approve their bitcoin ETF applications, and the SEC has repeatedly denied them on the grounds that the bitcoin market is still potentially easily manipulated. At one point in 2021, I had counted more than 10 spot bitcoin ETF applications and stopped counting after they kept getting denied.

But on Wednesday, Grayscale didn't just take the SEC rejection lying down. Instead, the company turned around and sued the SEC, claiming the agency is “failing to apply consistent treatment to similar investment vehicles, and is therefore acting arbitrarily and capriciously in violation of the Administrative Procedure Act and Securities Exchange Act of 1934.”

It may still be a losing endeavor in getting approval for its ETF, so long as the SEC maintains is positioning. Then again, maybe it's not the point.

Right after the SEC made its decision, Grayscale put out its press release that it would be challenging the SEC this time rather than all the other rejected applicants who walked away with nothing but hopes of refiling again. Many people on Twitter applauded the move, and it might wind up bringing more attention to Grayscale's trust in the meantime anyway.

Bloomberg in the run up to the SEC's decision made the case that Grayscale was stuck in a lose-lose: Either they win the first ETF and inevitably others get approved as well very quickly on their heels and the fees get cut in a race to the bottom, or their application gets denied.

But this appears to be the third scenario where Grayscale has the audacity to go on the offensive by pushing its case in court. Maybe it still gets approved first if it wins there. And maybe enough people follow that legal battle to care that much more. Because what's winning victory really worth anyways, without a little battle for the audience to watch?

Thanks for supporting Crypto Uncomplicated. Your premium subscription helps make this all possible. While we appear to be entering a longer bear market, we are approaching a phase where making project specific bets might pay dividends over the long-run. Next month, premium subscribers will get a first look at one of the most promising builders.

If you see other things you want explained, please don't hesitate to hit us up!