- Crypto Uncomplicated

- Posts

- The SEC's Biggest Crypto Critic Is One Of Its Own Commissioners

The SEC's Biggest Crypto Critic Is One Of Its Own Commissioners

SEC Commissioner Hester Peirce Tells Me Why The SEC Is Wrong

Considering all of the ways the Securities and Exchange Commission has now tried to crack down on the crypto industry, it’s not surprising there are more and more dissenters calling out problems with America’s top financial cop.

What might be more surprising, however, is that one of the loudest dissenters is actually one of the SEC’s five Commissioners herself – Commissioner Hester Peirce.

In a new interview with the community-owned Web3 outlet Coinage, Commissioner Peirce lays out her largest laments working at an agency that she claims is no longer regulating crypto on a neutral basis.

“I understand why you want to warn the American public that if someone comes to you and is offering you something related to crypto, it might be something that is not legit and you want to ask some questions, that's fine. I mean, we put out those kinds of risk alerts about all kinds of things,” she tells me. “But this whole notion that there's a whole separate set of standards that apply — a separate higher set of standards that applies in the crypto space than anything else — that to me doesn’t sound very ‘tech-neutral.’”

And yet, SEC Chair Gary Gensler has been publicly claiming for months that the SEC has been operating in a totally “tech-neutral” capacity in its war on crypto. He’s not saying crypto is bad, Chair Gensler claims, just that it’s not good. (lol)

Coinbase CEO @brian_armstrong calls out Gary Gensler’s claim that the SEC is being “neutral” on whether crypto has a use case:

“We don’t need the government picking and choosing our technology winners; let’s let the market decide that.” 👏

— Coinage (@coinage_media)

6:39 PM • Jun 7, 2023

During our conversation, an uncharacteristically open Commissioner Peirce explained to me that the SEC has continued to police the crypto space with an unfair bias towards assuming the technology itself has no merit and therefore must be stopped. When pressed further, I asked if other agencies within the government were colluding to take crypto down. She paused and then declined to speculate before noting there is an apparent coordinated effort to get banks to distance themselves from crypto:

“I'm not going to speculate about that, but what I will say is there have been a lot of public pronouncements from regulators, mostly at the federal level, that have sort of suggested that engagement with crypto is problematic.”

The interview was actually one of my favorites since I started covering crypto — not just for how many topics we fit into just 30 minutes, but for Commissioner Peirce’s impassioned closing on why it’s so important for us a country to correctly land on a right answer to regulating crypto.

“There are statutes on the books and we uphold those statutes, but I'm always thinking about upholding them in this frame of ‘liberty is super important in the United States' and I fear that in the conversations around crypto, we've lost a little bit of that sense of of how important that principle is in the United States.”

Other Takeaways:

Commissioner Peirce also weighed in on the latest Bitcoin ETF applications from BlackRock and Fidelity getting refused: “The standards we've been applying with respect to Bitcoin exchange traded products have [not been] ... consistent with how we've treated similar products," she said.

Commissioner Peirce delivered one of the funniest lines I’ve heard this year with a legendary response to my question on Chair Gensler’s repeated claims that crypto companies are willfully bucking compliance by failing to “come in and register with the SEC.”

"Well, I mean, I haven't seen a lot of evidence of it working very well," she said. 💀 (Coinbase has arguably conversed most with the SEC… they are now getting sued by the SEC.)

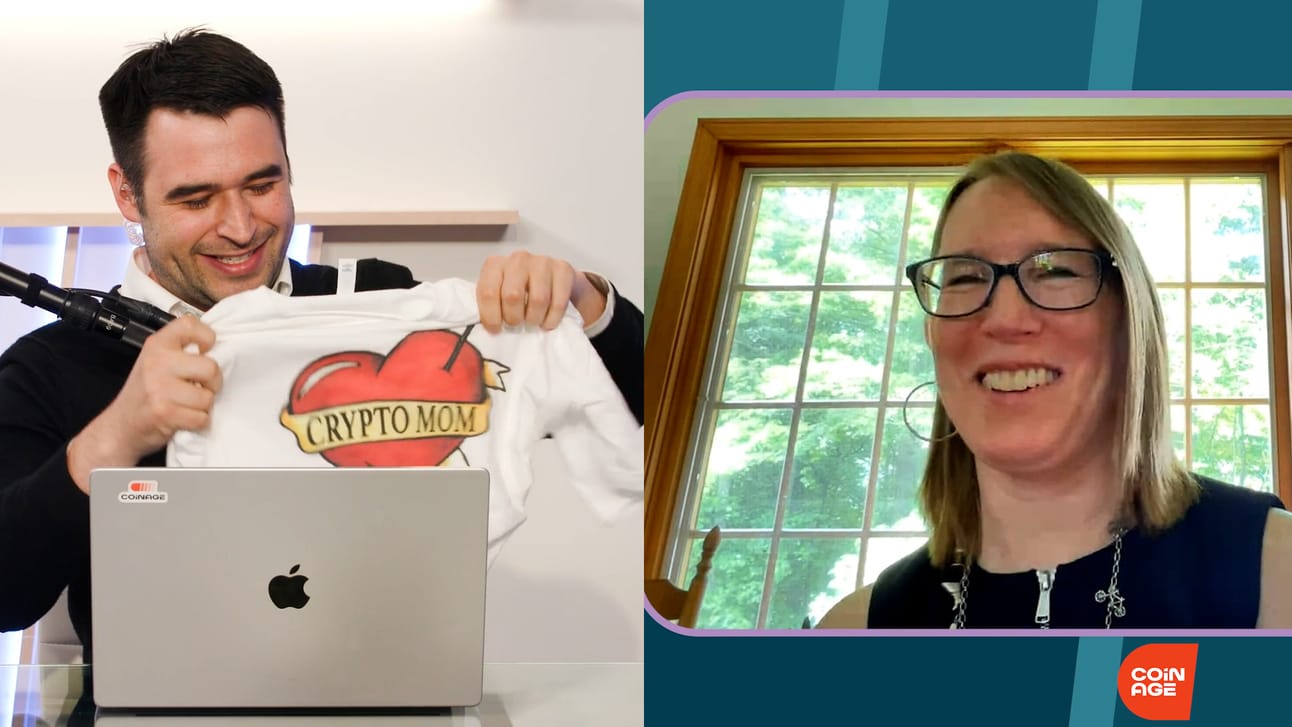

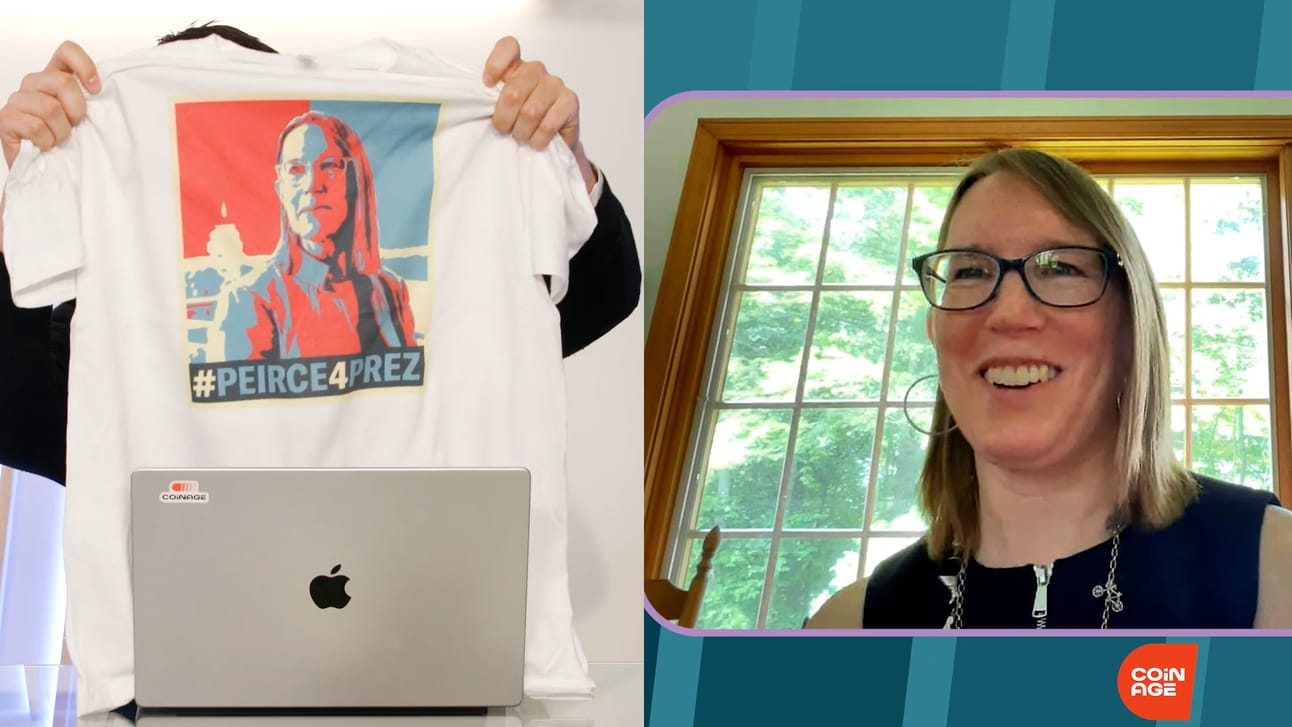

Commissioner Peirce laughed at the shirts we made for her to celebrate our interview with the SEC Commissioner affectionately known as “Crypto Mom” for her common-sense position to let companies experiment with the new technology.