- Crypto Uncomplicated

- Posts

- Maximizing crypto yield by moving it off exchanges like Coinbase

Maximizing crypto yield by moving it off exchanges like Coinbase

"Staking" unlocks additional returns that you could be leaving on the table

If you could hold the same currency but make more in interest off it somewhere else, wouldn't you move it there?

Logic (and capitalistic self-interest) would dictate the answer should be, "Yes! Make my money work for me!" And yet, plenty of my friends keep their crypto on centralized exchanges like Coinbase and forgo what could be more than three-times as much yield without additional risk.

I think part of the reason is they just don't know the option exists. Let me show you how.

First off, it helps to know a little of the background on where this additional opportunity to have your crypto work for you is coming from. It starts with how these networks function. In my first post, I walked through the importance of understanding how bitcoin miners are rewarded for their "proof-of-work" to secure the Bitcoin network. Instead, many other cryptocurrencies operate on what is called "proof-of-stake" to secure their networks.

As a simple comparison, proof-of-stake is different than proof-of-work in that it doesn't require miners to solve complicated math equations in order to be selected to add records of transactions to a network. Instead, validators are randomly selected, in part, based on how much of the network's cryptocurrency they have posted as collateral. Just like miners, selected validators get to earn all the transaction fees that are paid by the users transacting on the network in any given block.

The important takeaway from that difference is this: when you buy crypto that is part of a proof-of-stake network, you could be "staking" those coins with a validator in order to help them earn fees. Thus, in order to attract more coins, validators are incentivized to share a percentage of the fees they generate with the people who choose to stake their coins with them.

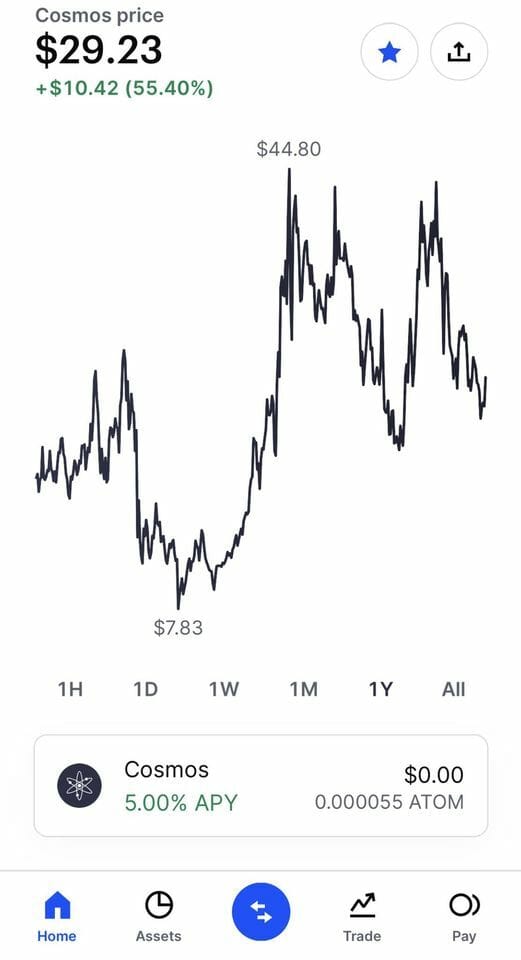

Let's use a real-life example to show what this means. Take the Cosmos network, for example, and its native cryptocurrency ATOM. Right now, you can buy ATOM on Coinbase and earn 5% APY by staking directly with Coinbase. Seems fair. You're helping Coinbase earn fees if they are selected as a validator for any given block of transactions on the Cosmos network.

A screenshot of Coinbase's advertised 5% APY staking reward for ATOM. You can think of this as the amount of interest your amount of ATOM would be earning.

Now, what if you were to move your ATOM tokens away from Coinbase to another validator? What could you make over there? Well, a quick review of the rewards being paid out by Cosmos validators shows that the number is more than three-times as high at 16.09% APY. All for holding exposure to the same crypto you would've been holding on Coinbase.

Of course, that process requires a little bit of work, so maybe it's not terribly surprising to think that not everyone would take the time and effort to create a Cosmos-enabled wallet (Keplr) and worry about controlling the private key to that wallet themselves. And to be fair, there is some level of security and ease in just leaving a quantity of coins in Coinbase or whichever exchange you use. But for anyone who trusts themselves enough to not lose a password or wants to take crypto seriously, there is a lot to gain in controlling your wallet's private key yourself.

For those curious to get started, I'm including a private video link below to a private 10-minute tutorial and discussion I had with a friend and crypto trader that walks through setting up a Keplr wallet for Cosmos. For other cryptocurrencies, the takeaway and process is largely the same: download wallet software that's unique to a chain, create a wallet and store your personal key, transfer funds in from an exchange, stake with validators to earn higher rewards.

In any case, the purpose of this post was not necessarily to dive deeper into what the Cosmos project is all about (I'll save that for another paid post.) It's more just to serve as an example of one crypto being offered for purchase and staking on Coinbase and other exchanges at a rate that is lower than what you could be earning elsewhere. That is true for a lot of what is offered on centralized exchanges. The point of highlighting that is to make it a bit more obvious as to why self-custody is important.

The phrase "Not your keys, not your coins" is popular in the crypto world for a reason. If you have crypto on an exchange like Robinhood, but don't actually have the key for your wallet you don't really own the crypto. You own an IOU from Robinhood saying you own the crypto. It's one step removed and unfortunately locks you out of opportunities like natively moving funds away to stake elsewhere.

Was this post helpful? Are there other questions you want answered? Keep the feedback coming in comments or DM's or email at [email protected]. I am always looking for guidance on what to cover next! Let me know!

Z