- Crypto Uncomplicated

- Posts

- How to identify promising NFT projects (and one to watch)

How to identify promising NFT projects (and one to watch)

Hint: It's not about the art

In a world where a drawing of a cartoon monkey can rise in value from $200 to $250,000 in less than a year, it may seem difficult to stay committed to logical thinking.

And, on its face, it might seem easy to brand the rise of the Bored Ape Yacht Club and their cartoon monkey NFTs aside as absolutely illogical.

Yet, as I covered in last week’s post exploring the project, there is usually a logical explanation somewhere (even if you don’t subscribe to its thinking.)

With this post, I won’t attempt to persuade anyone on the inherent value or price of any given NFT project, but I hope to lay out some logical ways to explore the value of NFT projects, and one specific project in particular that represents my first and single most-expensive NFT purchase to date.

In this photo illustration, the mobile phone version of leading marketplace and exchange for non-fungible tokens, or NFTs, OpenSea, shows ratings for the popular digital collectibles known as CryptoPunks, art works purchasable using cryptocurrency with a unique proof of purchase stored on the Ethereum blockchain. (photo by Daniel Harvey Gonzalez/In Pictures via Getty Images)

An NFT Primer

Logically, anyone who is native to crypto already understands the principle of digital scarcity. Bitcoin has provided the earliest and perhaps the easiest example: There will only ever be 21 million bitcoin in existence. So, therefore, over a long enough time horizon as demand for bitcoin rises and it becomes more scarce, its price should also rise. Seems simple enough.

Non-fungible tokens usually leverage the same understanding. Any given project will usually be composed of a set number of NFTs as dictated by their respective smart contract, or code that sets each collection's parameters. In the case of Bored Apes, there are only ever going to be 10,000 NFTs (a total that has roughly landed as standard for subsequent NFT projects.)

But just because there is a capped number of something, it doesn’t logically follow that the price must go up. Indeed, a fair number of NFT projects that never sell out when they are first dropped at their mint prices never even get to enjoy the concept of digital scarcity. Newcomers will just opt to mint a new NFT rather than buy one held by a previous owner at an inflated price on a resale market. In other words, until an NFT collection is fully owned, the “floor price,” or the lowest price at which any NFT owner would be willing to sell, is never really established above the mint price.

A screenshot of the Bored Ape Yacht Club Open Sea page shows a floor price of 106.9 ETH, or more than $325,000 at today's price.

This often leads to a phenomenon whereby some owners, or speculators, scoop up all the remaining NFTs in a project (otherwise known as “sweeping an NFTs floor”) to establish a higher floor price. Once a collection is fully owned and new prospective buyers can only buy from an existing NFT owner, the games begin.

Now, if it sounds like a market structure like this might be ripe for fraud or disingenuous behavior, you would be correct. Indeed, oftentimes projects will mint and hold a certain amount for themselves in order to turn around and gift them to influencers for free promotion. As I’ve highlighted before, the YouTube documentary “Line Goes Up” has attracted more than 6 million views for its critical takedown of the problem with people cornering NFT projects and the games played by many NFT creators to establish a mirage of demand in order to boost floor prices (of course, you could also make the case that many real-world art collectors also do this at auction.)

Either way, the fact remains that a collection’s floor price is only as strong on the resale market as an NFT project’s weakest individual holder. A collection’s price is only as strong as its weakest link. Otherwise, a low offer might get accepted and drag down the price attached to any other NFT in the project.

To seemingly battle back against the threat of “weak” holders, NFT projects double down on digital scarcity of a second kind. Not only are NFTs, by definition, non-fungible in that they generally can’t be swapped one-for-one in the same way that any one bitcoin can be traded for any other bitcoin on an exchange like Coinbase, NFTs often have individualized traits of varying scarcity. In the case of Bored Apes, this could be that any given ape drawing could feature 3D glasses, or a hat, or a colored background. Each trait, and its designed rarity, helps build rarity on top of a project’s scarcity.

What’s interesting is that early NFT projects don’t seem to be teasing out any perceivable upside for trait rarity beyond resale price. For instance, all Bored Ape Yacht Club holders received the same amount of ApeCoins (10,094 $APE tokens) airdropped to them regardless of the rarity traits represented in their NFTs. I suspect that could change in the future.

NFT Strategy

Given those two major variables of rarity and scarcity, it’s generally easiest to latch on to those to try and calculate the value of any given NFT. There are a number of sites that help parse the parameters of a smart contract to calculate not only trait rarity of NFTs in a given collection, but also “unique” owners of a given collection (I put “owners” in quotes because this number usually only represents unique wallet addresses that hold a collection’s NFTs. In theory, all of those wallets could be owned by the same person, thus giving the illusion of more owners than there actually are.) Aside from the NFT platform OpenSea (which tracks price activity and “owners”) other sites like Rarity.tools and Howrare.is offer more insights on measuring the rarity of traits in specific projects.

In measuring momentum of certain projects, other sites like icy.tools and nft.stats measure sale prices and sale volumes of hot projects.

However, as useful as some of these metrics might be, there is a case to be made that a higher-level thought process might be warranted.

For example, many of the first large NFT projects were launched on Ethereum (including Bored Ape Yacht Club and Crypto Punks.) But as other competing blockchains have scaled, more NFT projects are launching on other chains like Solana, Terra, and Avalanche.

Given that advocates and owners of the cryptocurrencies on those respective networks want to support activity on those networks, it’s not a surprise to see power players quickly throwing their support behind the first collections being launched there. For example, the co-founder of Solana Labs Anatoly Yakovenko features a Thug Birdz NFT as his profile picture. The project is a 3,333 NFT collection of Crypto Punk-inspired pixelated birds currently boasting a floor price of 35 solana, or $3,500, at time of publication.

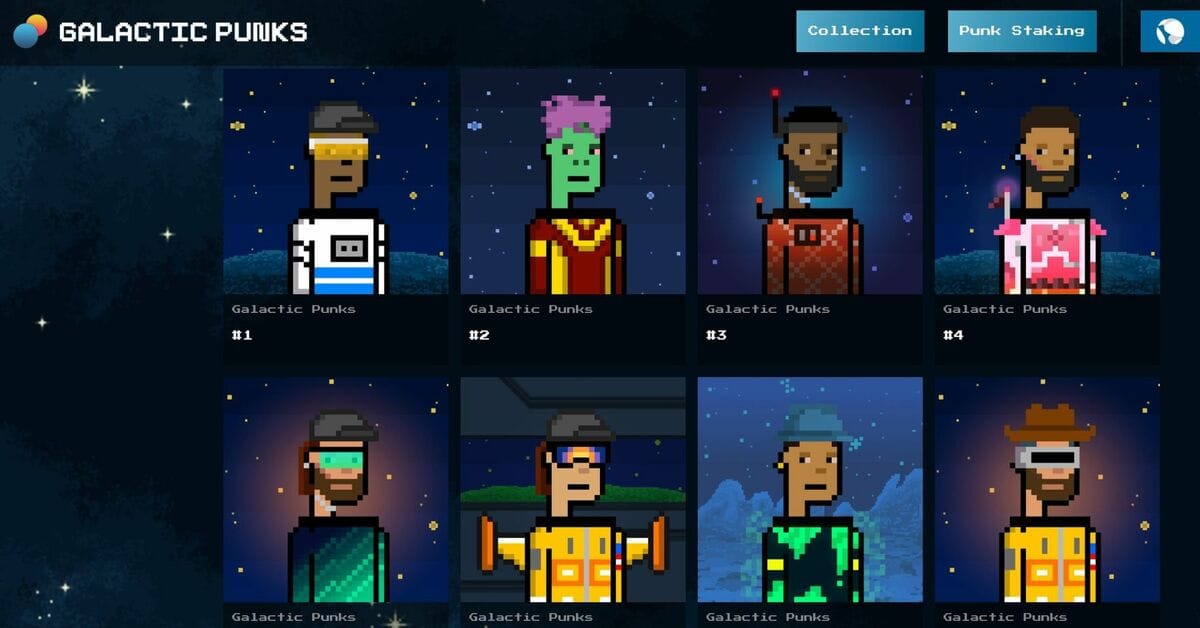

Meanwhile, on Terra -- a cryptocurrency project that soared more than 13,000% in 2021 (paid Crypto Uncomplicated post) -- many of the highest-profile team members at Terraform Labs use Galactic Punks as their Twitter profile pictures. The project is Terra’s largest and most actively traded NFT collection and features nearly 11,000 pixelated characters with a floor price of 38 Luna, or $3,420, at time of publication.

A few weeks ago, I bought a Galactic Punk on the Terra NFT resale platform Random Earth for 20 Luna, or about $1,500 at the time.

Why I bought a Galactic Punk

My theory in buying a Galactic Punk was four-fold.

It’s the most active NFT project built on Terra and also claims to be the first fully-audited project.

It’s heavily touted by Terra’s founding team and other active members of the Terra ecosystem. Because of that, other projects often offer airdrops, or freebies, to holders of Galactic Punks in order to attract important eyeballs on their projects.

Galactic Punks are far from just art. Galactic Punks are also tickets into the GalacticDAO, a decentralized autonomous organization which currently runs a Terra validator and uses that revenue in-part to buy back Galactic Punks at floor prices. The DAO then raffles those Punks to people with wallets who stake Luna using the DAO’s validator. Other validator revenue is routed to the Galactic DAO treasury, which is controlled by its members.

My Galactic Punk kind of looks like me. :)

If that wasn’t enough, I recently met two of the members working on Galactic Punks on the sidelines of the Avalanche Summit in Barcelona. They were excited about the latest step in the Galactic Punk journey.

Now, owners of Galactic Punks can stake their NFT punks to earn token rewards from projects the GalacticDAO is supporting. More specifically, GalacticDAO members recently voted to invest in two NFT marketplace startups, Luart and Messier. Tokens earned from those investments will be distributed via an 80/20 split to Galactic Punk owner wallets choosing to stake their Punks and the DAO treasury. Interestingly, tokens are distributed evenly to punk holders – irregardless of an NFT’s rarity or price.

In effect, the DAO has shifted into a part-validator, part-investment club. And thus, the Galactic Punk NFT itself has evolved beyond just art to now look like a weird mix of a bond with a steady yield and an equity stake in an investment club.

What are the takeaways?

There are a few important takeaways here writ large in regards to NFTs. The most obvious is that NFTs are quickly evolving beyond digital art and community and becoming yield-generating assets.

The second important takeaway I discovered in my three-month experiment with my Galactic Punk, is that NFT prices move in a strangely disconnected pattern with the price of the crypto used to buy that NFT. For example, I paid 20 Luna for my Galactic Punk. As the price of Luna dipped in dollar terms from $90 to about $70 per coin, I expected to see prices for Galactic Punks also fall. That didn’t actually happen. And similarly as Luna recovered to $90, Galactic Punk prices continued their churn higher. The floor price is now 18 Luna higher than when I bought my Punk.

In theory, this would seem to indicate an arbitrage window for people to buy Galactic Punks with Luna when the price of Luna falls to enjoy a levered return if and when Luna’s price recovers. For example, the Luna I used in January to buy my Punk has appreciated in dollar value by 19%. I could’ve just held that Luna and sold to enjoy that return. Instead, my Punk, which cost 20 Luna in January, would now feasibly fetch about 38 Luna at the current floor price. If I sold my Punk now and immediately sold that Luna for dollars, that would constitute a 133% return in dollar terms. Thus, the important takeaway: buying NFTs can, in a way, be looked at as levered bets on the crypto you’re using to transact.

The last important takeaway is to look toward projects with active developer teams. It’s easy to point to Yuga Labs and what they have done with Bored Ape Yacht Club and the move to scoop up the intellectual property of other leading NFT projects. Their first-mover advantage could have easily lost steam, but they kept building. As a result, their NFTs continue to climb in price and their owners have received airdrops that make their returns virtually impossible to be anything less than historic.

To be clear, I’m not saying Galactic Punks have any sort of guarantee to deliver returns even close to what Bored Ape owners have enjoyed. But, when it comes to balancing risk and reward, I do think the process of even calculating a return will become an increasingly interesting game as NFTs continue to evolve from static art pieces to yield-bearing assets. Might as well pick a chain, and take a swing at the leading project.