- Crypto Uncomplicated

- Posts

- Crypto's largest stablecoin experiment just evaporated $40 billion

Crypto's largest stablecoin experiment just evaporated $40 billion

"History doesn't repeat itself, but it often rhymes”

Crypto Uncomplicated is a free crypto newsletter distilling all the happenings in the crypto space. Unlock the full experience as a premium subscriber by signing up here.

It finally happened.

After battling to stay alive, crypto's largest algorithmically-backed stablecoin project, Terra, has finally died.

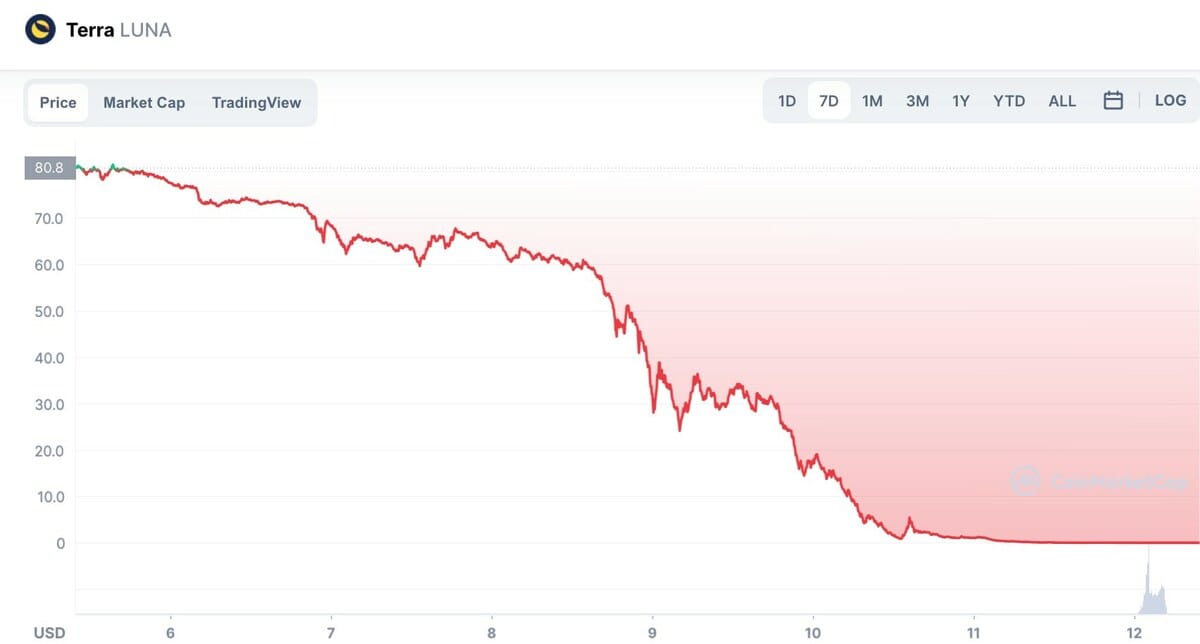

In a shocking collapse, the LUNA token it was built on dropped 100% this week from $80 to $0.

As I covered earlier this week, the tremors started when Terra's stablecoin UST broke from its intended peg of $1. By design, UST is supposed be maintain its $1 value by an algorithm that mints or burns LUNA tokens based on market demand. As UST falls under $1, more LUNA is created to suck unwanted UST out of circulation. That's how it's supposed to work. That's how EVERY algo-backed stablecoin is supposed to work. And as I covered, they work fine as long as people believe in them to hold their value. When panic sets in and people doubt the stablecoin will stay at $1, it's all over.

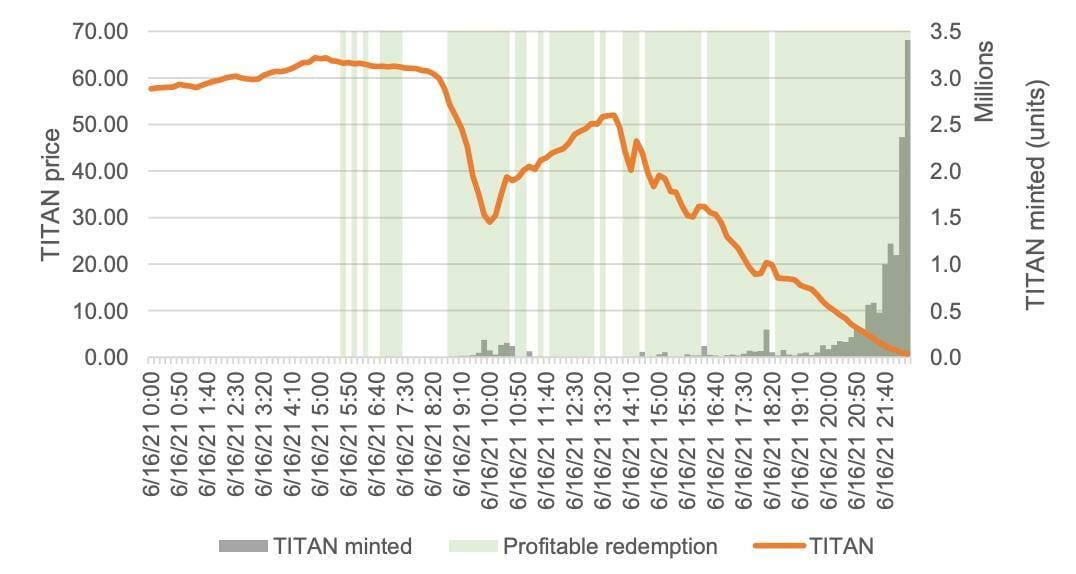

That's what is particularly fascinating here. History has its lessons of other failed projects that have tried to accomplish literally the same thing Terra set out to do. Last year, even Shark Tank's Mark Cuban got burned by the same idea. Iron Finance's IRON stablecoin broke its peg, and the underlying crypto backing it called TITAN went to $0. (The chart below, borrowed from a paper doing a deep dive on that bank run, follows the exact same pattern of Terra/LUNA this week.)

I knew these risks. I've documented these risks. I've written about the risks. And yet, it didn't stop me and millions of others from investing in Terra. It had battled back from prior episodes of UST breaking 20 cents below its before. Even in failure, the system worked as intended right up until the last moment. And even as things looked shaky this week, there was still a chance Terra could rescue itself to live another day.

We saw this play out on Tuesday, as Terra Founder Do Kwon took to Twitter to buy himself some time. "Close to announcing a recovery plan for $UST. Hang tight," he tweeted.

But as he and Terra were trying to figure out a recovery plan, things were unwinding in very real time. As I detailed in the midst of the panic, people were dumping UST for 70 to 60 cents on the dollar as they feared it would never get back to peg. Indeed, as more and more LUNA was created to try and suck unwanted UST out of the system, LUNA's value -- the very thing collateralizing UST -- was continuing to tank. Terra was running out of options, and as the Block reported, an emergency rescue deal to raise more than $1 billion to try and stop the panic fell apart.

Unlike in traditional banking, there is no "Crypto Fed" to reverse a panic with a potential bailout of unlimited money printing. Terra unleashing $2 billion in bitcoin reserves looked paltry as it faced a sea of $14 billion in UST getting dumped on the market. A rush for the exits only intensified as it became clear there would be no rescue deal. The deposits of UST on Terra's largest decentralized app (Anchor) quickly fell from $14 billion on Friday to less than $2 billion by the end of the week.

And yet, the crazy thing to think about with any bank run, is that it would have been fine if people just stopped panicking. If there was any sort of messaging to cling to, maybe people would have stopped panic selling UST for cents on the dollar and Terra's algorithm could adjust to bring its peg back to $1. Sure, LUNA's price might have been dented from $80, but maybe it would've held at $30.

But to appreciate why any any short-term solution like that might not have mattered in the long-run, it's worth digging into what exactly triggered Terra's collapse in the first place.

As I mentioned in the last post, people with a lot of capital have a lot of control. They can put that capital to use and exploit market inefficiencies, or currencies that are artificially being held up. Based on the data, it is likely that someone executed an incredibly lucrative short play on LUNA by instigating the UST de-pegging event and augmenting the panic throughout the week.

In my reporting, sources at the financial giant Citadel denied that they were behind such a move. That was later confirmed by an official spokesperson. But let's dig into how someone, or a group of actors, likely planned this one out.

First, Terra was at least aware of the potential for someone to try this.

I say that because Terra's Do Kwon laughed off a long tweet thread back in November which went into step-by-step detail as to how someone could make a ridiculous profit by attacking UST's peg with just $1 billion. In response, a confident Kwon added, "Billionaires in my following, go ahead, see what happens."

It appears someone took him up on it.

The order of events were well timed. On the decentralized finance protocol Curve, Terra was set to withdrawal some of its UST from a pool of assets as part of a pre-announced and planned transfer of funds to move to another trading pool. By itself, it wouldn't necessarily be cause for concern, but right after, some other actor decided to withdrawal their own UST from the same pool as well, causing an initial wobble in UST's peg down to 97 cents. Again, by itself, nothing major.

Step two would amplify concerns. Billions are then withdrawn from Terra's savings protocol Anchor. Everyone can see this publicly on-chain. A large withdrawal signals to smart money that something is up, and others follow suit in taking their UST out. It'd be like a literal line of people crawling over each other to take their money out during a real old-fashioned bank run.

The last step is where it seems clear someone coordinated this. Millions of dollars worth of UST begin to get dumped on the trading platform Binance. Their order book gets so heavy with trades below the $1 peg that it eventually halts trading and withdrawals on UST. At that point, the panic is public. The death spiral becomes far too large to unwind and Terra is left with moves that can only buy time for its community to try and get out.

Unfortunately, Terra's system requires about a three-week lock up period for staking rewards to secure the network. So even as many watched the system collapse, their funds were locked and they were unable to do anything to offload their LUNA.

Eventually, Terra took the last step on a dwindling list of options to try and prevent a disaster from spilling over into a Chernobyl by halting its chain. It's a drastic step for any blockchain which basically shuts down the ability for anyone to do anything on the chain - no withdrawals of either UST or LUNA, no sends, no swaps from LUNA to UST, no unstaking. Nothing. But by Thursday, LUNA had become so cheap if Terra chose not to halt the chain there was real concern somebody could take over the entire network.

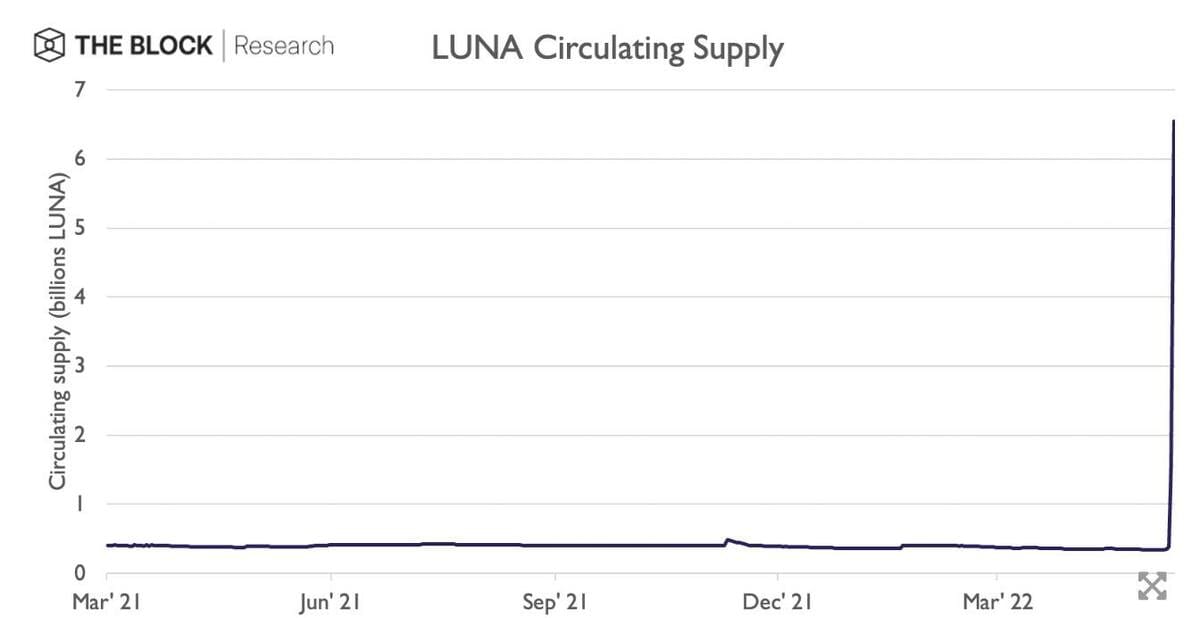

So, in the end, what do we have? Another failed algo-backed stablecoin. LUNA is not coming back. Its supply increased from under 1 billion to more than 6 billion and will continue to be diluted as more is printed. Barring a miracle UST is never going back to peg, either. As of Friday morning, UST is trading at just 16 cents.

As Terra's algo continued to burn UST and mint LUNA, LUNA's supply skyrocketed (Source: The Block)

Crypto's reputation is beyond dented. This wasn't just some small project. It was a huge, top-10, high-profile project worth $40 billion this month with major keynote backers, including billionaire Mike Novogratz (he even got a LUNA tattoo this year!)

How the Terra team wants to handle this one remains to be seen. There is no shortage of examples of retail traders losing tens of thousands of dollars, if not more. Do Kwon was already the target of an SEC lawsuit over his connection to Mirror Protocol, which allows users to trade synthetic assets (tokens linked to actual securities like stocks.) The fallout from that operation and others connected to the Terra ecosystem also remains to be seen.

Some people in the Terra community this week were lamenting the fact that it was such a good product from a user perspective. And indeed, it was a phenomenal experience -- up until it eviscerated your savings. Others were dreaming up a scenario where the chain gets rolled back to before this attack ever happened.

Weirdly, I could see a scenario where that happens. If the reports of some people wanting to rescue Terra in its final moments were true, maybe they are still there when the dust settles. Maybe they revamp the thing to become fully collateralized like other stablecoins. What's the cost of acquiring users? It'd be easy to airdrop a new stablecoin to users who got burned.

Then again, maybe that's just wishful thinking. However, it's worth mentioning ethereum did pull off a similar rollback on their own chain when it was exploited by an attack (that was a single transaction though, and Terra's situation is massively different.)

In the end, history warned us Terra's demise was a possibility. The signs were there. The risks were obvious. Smart money likely hedged and a lot of little guys got caught in the panic. Another crypto lesson learned (again.)

Crypto Uncomplicated is a free crypto newsletter distilling all the happenings in the crypto space. Unlock the full experience as a premium subscriber by signing up here.