- Crypto Uncomplicated

- Posts

- Could a crypto up 13,400% in 2021 really just be getting started?

Could a crypto up 13,400% in 2021 really just be getting started?

Terra is attempting to solve a problem that has killed countless other crypto projects

Even in the wild world of crypto, fundamentals still matter.

A "hot" crypto project without the fundamentals to back it up might see a short-term price pop, but in the end get dragged back down to earth when the hype dies out.

But sometimes (very rarely) a crypto project can come around that not only promises to fix a core problem, but also boasts the early fundamentals to back it up.

So far, that project has been Terra — rising more than 13,400% in 2021.

What is Terra and why is it so groundbreaking?

Terra is now the ninth largest cryptocurrency project, with a market cap north of $26 billion. Its Terra network is powered by its native cryptocurrency Luna. The problem it is trying to solve is arguably one of the most important in all of crypto. Other crypto projects have tried solving the same problem — and many have died trying. In order to understand the potential upside in Terra, let's start by addressing that very problem.

Bitcoin and ethereum can tend to be volatile. They are argued to be long-term stores of value, but on a day-to-day basis when their price can fluctuate, they don't function well as a "digital dollar." For traders looking to cash out, (and anyone dealing with crypto payments) having something more stable would be an obvious plus over having to deal with price fluctuations.

Enter the so-called stablecoin: a cryptocurrency designed to have a relatively stable price, typically through being pegged to a commodity or currency.

The original stablecoin, Tether, was introduced in 2014. The company backing it, Bitfinex, promised to hold an equal amount of assets under custody to correspond with the number of tokens it would mint to always keep them trading at $1. So let's say Bitfinex has $50 million in a bank account, they could issue 50 million Tether stablecoins all for $1.

Tether is by far the largest stablecoin in issuance today at a market cap of nearly $80 billion. The Coinbase-aligned USDC is the second largest stablecoin at a market cap of $53 billion.

It's worth noting the hypocrisy that stablecoins introduce, however. For a system like crypto (which is meant to function without trusted intermediaries like banks) stablecoins sure are operating on a lot of trust. Who is to say the businesses backing them really do have the assets under custody they purport to have? Bitfinex, for its part, settled a case brought against the company by the New York attorney general's office which alleged it misrepresented its funds a few years back. Bitfinex has released financial attestations of its holdings, but has never undergone a full independent audit.

Even USDC has run into its own embarrassing issues. For a while it was marketed as backed "one-for-one" by dollars on Coinbase. Its own financial disclosure later revealed that it held short-term corporate debt and treasuries along with cash, making any claim that its stablecoins were backed "one-for-one" by dollars verifiably false. The company later apologized for not making that point clear.

Plus, if all of the money or assets backing these stablecoins are centrally held in a bank account somewhere, doesn't it become rather easy for regulators to shut them down if they so choose?

In order to solve the problems that asset-backed stablecoins like Tether and USDC introduce, crypto projects like Terra offer a different solution. Instead, Terra offers a stablecoin that isn't backed by dollars in a bank account at all. It offers what's called an algorithmically-backed stablecoin.

Algorithmically-backed stablecoins are just that — stablecoins that aren't backed by real assets, but instead are backed by code that promises to keep the value of its stablecoin at $1.

In the case of Terra, its stablecoin called "UST" is backed by its cryptocurrency called "Luna." Luna's price fluctuates up and down, but UST is always pegged to $1. Users can elect to convert Luna into UST at any time.

As Terra's founder Do Kwon has told me in interviews in the past, Terra's stablecoin is more resistant to regulatory threats because it doesn't touch the banking system like USDC or Tether do.

"The reason why this is valuable, is there's a lot of regulatory movements coming from jurisdictions all across the world to sensor the underlying bank accounts under stablecoins," he said. "The reason why the decentralized currencies like Terra are important and gaining lots of attention is because it's free from those things in the sense that because there's no underlying censorable deposit, the logic that's governing the monetary policy of these stablecoins are entirely free from censorship."

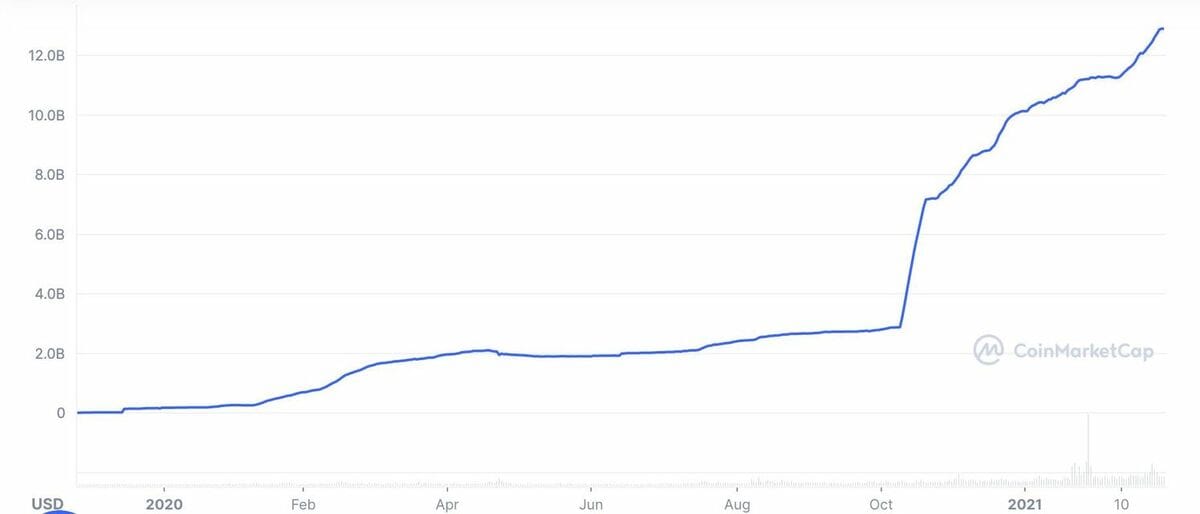

Getting back to fundamentals, it's quite easy to see where the value of a stablecoin like UST comes in if it can deliver on its promise of being a true decentralized dollar. Luna's price rising in 2021 has been a testament of the market believing it can. UST's market cap has swelled from just under $2 billion this past summer to more than $12 billion now, making it the largest algorithmic stablecoin in issuance.

UST's market cap has exploded from just $2 billion as recently as June to more than $12 billion. (Chart courtesy of CoinMarketCap.)

Theoretically, the more that UST is adopted, the more Luna's price should be pressured to rise. After a network change last summer, every time Luna is converted to UST a certain percentage gets burned. That deflationary aspect to Luna makes it a pretty simple bet: you buy it if you think UST is going to continue to get adopted by the wider crypto community.

That raises questions about the risks of that not happening.

For starters, as I said, many algorithmically-backed stablecoins have failed. Earlier in 2021 Iron Finance famously went bust after breaking its $1 peg. The project evaporated a total of $2 billion. Even Shark Tank host Mark Cuban was a victim, and later called for regulators to step into the space.

There is always a risk that UST could break its $1 peg as well, but it has held up in even the worst of bear markets so far. To add a layer of cushion, Terra also recently announced a limited reserve of $1 billion in assets to use in the event of an accelerated "run" to convert Luna into UST. Think of it as a $1 billion emergency fund:

"The reserve assets can be utilized in instances where protracted market selloffs deter buyers from restoring the UST peg’s parity and deteriorate the Terra protocol’s open market arbitrage incentives,” said the Terra group behind the purchase.

In the case of protecting against extreme volatility, I suppose there is a case to be made that if things got really bad, even $1 billion might not be enough to move the needle. Then again, Terra has functioned fine up until this point without it.

Finally, there is the issue of regulators. Terraform Labs, the parent company that originally introduced the Terra protocol, has seen some attention from the SEC. Terra co-founder Do Kwon was served at a New York crypto conference in 2021 in a case that is investigating Terra's Mirror Protocol — a market that lets users buy and sell assets that "miror" securities like stocks. Kwon has defended himself in that case reiterating that it doesn't centrally control a lot of what it built on the Terra network since it is now open-source.

"We are creators of these products and once we create them we hand them off to the community, including the entire ownership of the protocols, and I think that takes some time and getting used to," Kwon told me last year. "Regardless of what regulators think of the issue, there’s no change I can make to the Mirror Protocol. So when we say that Mirror is decentralized, it is fully decentralized. There is nothing that the creator can do to sort of cap the growth of the protocol."

In theory, any crackdown on Mirror could momentarily stall the adoption of UST. Then again, there are plenty of other services being built in the Terra ecosystem that is driving that adoption. Anchor, an automated savings protocol, has attracted billions in digital deposits by offering as much as 20% interest for customers. It's unclear how long that rate will be maintained.

There is also pending regulation around stablecoins. As those talks shape up in Washington D.C., there is a growing push to bring stablecoin issuers under the umbrella of the banking system. I don't know what that could mean for a player like Terra, nor do I know how regulators might attempt to block access to Terra in the U.S. if they deem it to be operating out of bounds.

All in all, however, it's clear that Terra has laid the groundwork to continue its adoption in 2022. Its Terra Station wallet is perhaps one of the best user experiences in crypto. Its currency pairs offers similar stablecoin functionality in currencies around the world, leading to global adoption.

If you believe the market for stablecoins will only continue to grow, Terra's UST and the Luna that's backing it are forces to be reckoned with.