- Crypto Uncomplicated

- Posts

- CNBC's Jim Cramer says he was wrong about crypto

CNBC's Jim Cramer says he was wrong about crypto

Does that mean... he was right about crypto?

There's an interesting theory about CNBC's Jim Cramer and his show "Mad Money."

To some, the investing strategy has become: Bet against every single investment idea he ever has. Because by the time he's talking about it on TV, it's already played out.

As a fellow Harvard grad and former CNBC employee, I would recuse myself from weighing in on that opinion directly (though I might point out that some have allegedly doubled their money by betting against his takes.)

That's what made his admission this week all the more interesting and noteworthy. During his Tuesday night broadcast of Mad Money, Cramer copped up to the idea he was wrong about crypto. In fact, he even went as far as floating the prospect that maybe CNBC shouldn't be covering crypto at all.

"I think it's time we start questioning the fundamentals of crypto not unlike when we questioned the dot-com movement in 2000-2001," he said. "When all things crypto took off with great fanfare like the dot-com bombs, we were told they were stores of value, that they meant something ... I'm at least big enough to admit that this time I was wrong about crypto."

A dejected Jim Cramer contemplates whether CNBC should cover crypto at all. (Source: Screenshot, CNBC)

So ... could that mean an inflection point could be imminent? Well, all jokes aside about fading any Jim Cramer takes, I suppose it depends on what you make of the comparison between crypto today and the dot-com bust in 2000. All in all, I think it's a very fair comparison.

For example, both eras were a time of runaway speculation. There's no doubt that could be the case today when people are still taking about flipping "CumRocket." But that's obviously only a surface-level scoffing off of the entire crypto space — and would be repeating a mistake many made in 2018 when they left crypto for dead.

And don't get me wrong, I get the importance of appreciating the fact that bitcoin is teetering on the cliff of $20,000 again. It's the first time ever that bitcoin has retraced to dip below a prior cycle's top, so yeah, it's pretty crucial.

But then again, only focusing on price would be making a categorical mistake of what makes crypto, crypto. As discussed in prior Crypto Uncomplicated posts, it's not as simple as comparing crypto to stocks. The reason being, is that they are different beasts altogether. Or ... are they?

Well, for one: Crypto is all about adoption. Even when the price collapses, people are drawn in. And when the price goes up? People are drawn in. That may be less evident in the U.S. when the use case of Bitcoin is rote speculation, but elsewhere (for better or worse) sometimes bitcoin is more than just that. It may be the best alternative to an even worse currency.

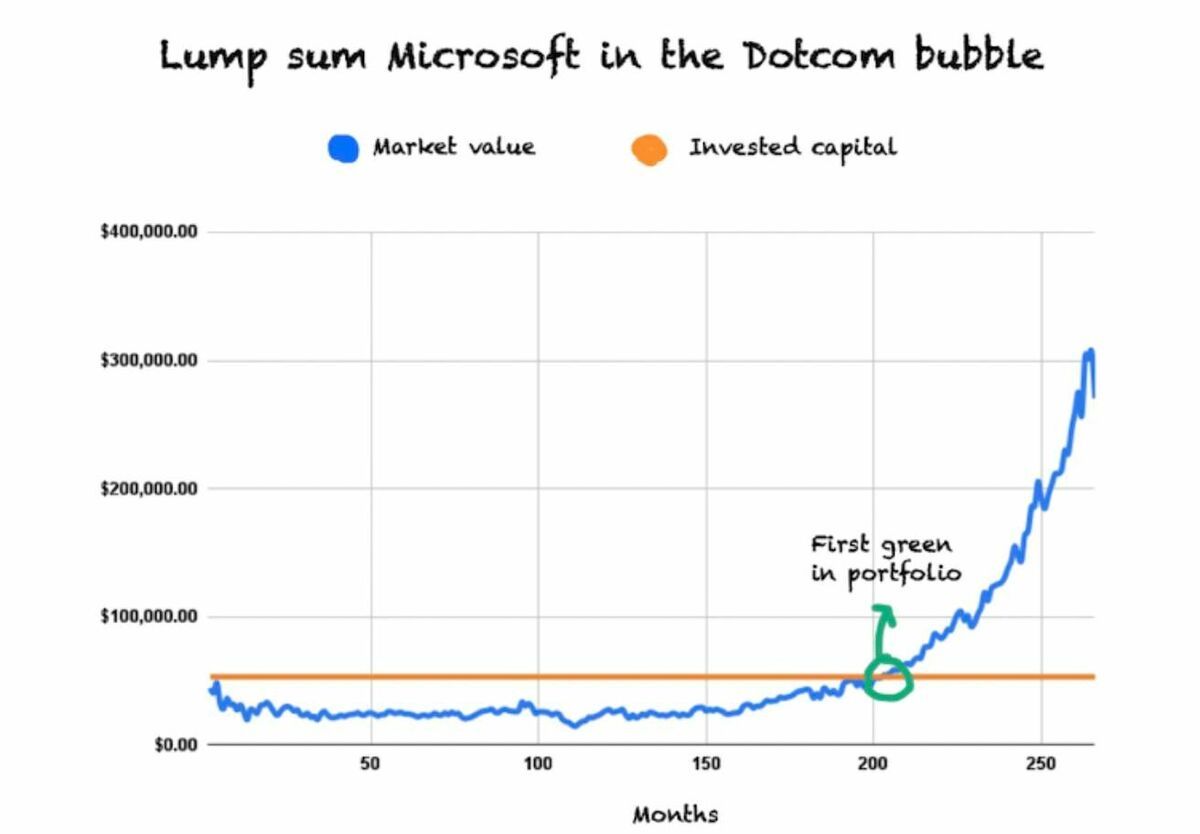

Perhaps more fair is an actual comparison to the dot-com bubble. To illustrate that, let's take a closer look at Microsoft stock back then, and how long it took to recover. It wasn't a snapback by any means, but even if you bought and held Microsoft in the dog days of the dot-com collapse, you'd still be up years later. In fact, you'd be up quite a bit.

A bet on Microsoft in 2000 took roughly 200 months to turn back into the green, but it got there. (Source: Best Anchor Stocks on SeekingAlpha.com)

And of course, for every Microsoft and Amazon in the collapse, there are three or four Pets.coms. The fact of the matter is there is overvalued trash in any speculative bubble. That's what makes a bubble a bubble. But if history is any indication, there is indeed staying power for the cockroaches who are able to show true adoption. And in the case of Bitcoin and Ethereum, this cycle has played out before.

And yes, you can make the claim that those crypto stalwarts aren't powering anything real. But, it's worth remembering that indeed each network takes a cut of a transaction to keep powering the network. That in-turn fuels the whole system and benefits every holder. In that sense, adoption does have a material impact on price.

It might be worthwhile to remember that. Particularly when the masses are listening to voices who might be saying they were, "wrong about crypto."

Thanks for supporting Crypto Uncomplicated. Your premium subscription helps make this all possible. While we appear to be entering a longer bear market, we are approaching a phase where making project specific bets might pay dividends over the long-run. This month, premium subscribers will get a first look at some of the most promising builders.

If you see other things you want explained, please don't hesitate to hit us up!