- Crypto Uncomplicated

- Posts

- An old-fashioned bank run is triggering crypto's Armageddon

An old-fashioned bank run is triggering crypto's Armageddon

What happens when one dollar is suddenly worth way less

Despite having literally thousands of crypto projects to focus on there has always been one I've covered more than any other. It's the granddaddy. The "shoot for the stars and even if you miss, you'll land among the stars." The David trying to slay Goliath.

Because in a world as revolutionary as crypto, why settle for anything less than burning the old system to the ground?

Well, as this week's intense sell off might prove out, because heavy is the head that wears the crown ... and you might just trigger one of the worst situations crypto has seen in a while.

Long-time Crypto Uncomplicated readers will know that I am talking about Terra and its stablecoin UST. The project exploded some 13,000% last year by delivering on a mission that nobody has been able to thus far. Unlike other stablecoins, or special cryptocurrencies meant to trade steadily at $1, Terra's UST isn't backed by tangible assets like cash. Instead, it's backed by Terra's other cryptocurrency, LUNA, which trades with much more volatile swings.

As I covered a couple weeks ago, issuers of stablecoins have become hell-bent on attracting buyers of their digital dollars. Most often, they try to reel you in with higher than average interest rates. Why? Because to have people scooping up your stablecoin as if it's as reliable as a real dollar is to be king in a world of pawns. To boast growth that's 10-times as fast as your competition, well, that's just next level.

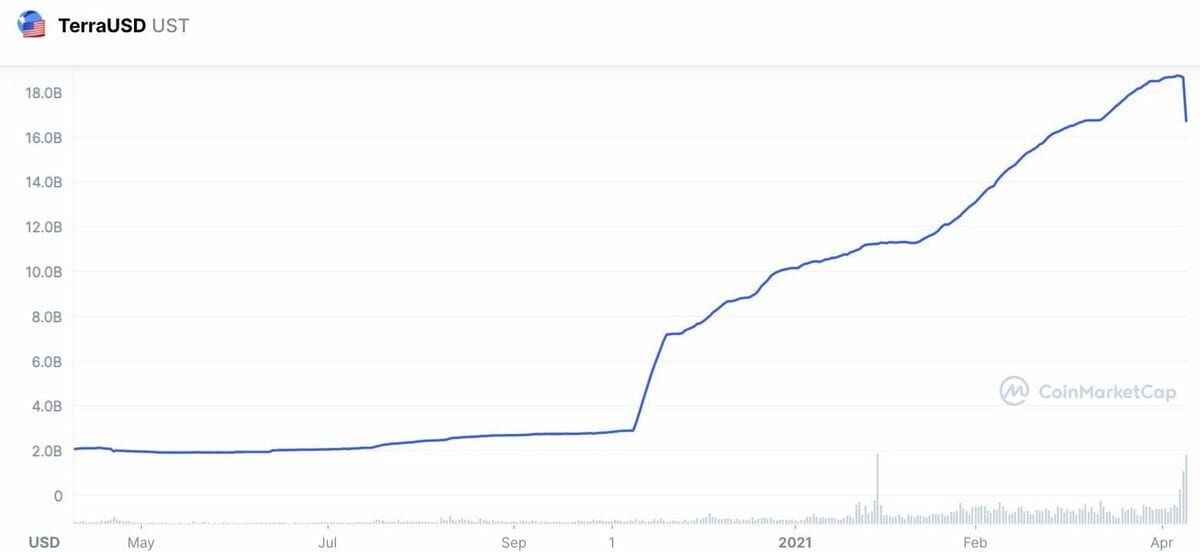

And yet, Terra was able to do all that and then some. Not only did the market cap of its UST stablecoin skyrocket from about $3 billion in November to $18 billion as recently as last week, it did so without having to hold an equivalent amount of dollars in a bank account somewhere to backstop UST's value. Unlike other asset-backed stablecoins, Terra is theoretically untouchable or unseizable by regulators. That was a big selling point for crypto's most ardent supporters looking to have a "digital dollar" that was truly separate from the traditional banking system. Of course, with high reward comes high risk.

Terra's UST marketcap surged from $2 billion to $18 billion in a matter of 6 months. (Source: CoinMarketCap.com)

As paid subscribers of Crypto Uncomplicated learned back in February, Terra's groundbreaking stablecoin works to maintain its $1 peg by leaning on arbitragers who swap between LUNA and UST any time the value of UST deviates above or below its dollar peg. When demand drives the value of UST above $1, arbitragers can burn LUNA to mint more UST, thus bringing UST's value back to its $1 peg. On the flip side, when demand contracts, arbitragers can conversely burn UST for LUNA. (If you're a visual learner, just watch Terra's graphic animation below.) The system all works well ... until it doesn't.

Strike one: If LUNA looks like its tanking, there's little reason for arbitragers to step in and swap for it to support UST's peg. LUNA is collapsing this week from an all-time high earlier this year of $120 to just under $30 a coin Monday.

Strike two: UST has arguably been able to beat competitors by offering an outsized 20% interest rate on its savings platform Anchor Protocol. That juiced interest rate sucked in about 75% of all outstanding UST. But as I wrote a couple weeks ago, the reserve that was making that outsized interest rate possible (roughly 330-times as high as the average bank interest rate) was quickly dwindling and only had about a month of runway left. For UST holders only there for the 20% APY, seeing UST drop to 80 cents on the dollar was just an expedited reason to dump.

Strike three: Terra realized its $1 peg could fall victim to what's called a "death spiral." In layman's terms, it's an old fashioned bank run: People lose confidence that they will be able to redeem their stablecoins for $1. Fear sets in, and people sell for 90 cents on the dollar, then 80, then poof, UST is worthless. To prevent that, Terra created a stand-alone pseudo Crypto Fed dubbed the "Luna Foundation Guard" which was meant to stockpile $2 billion in reserves to backstop UST's peg if a death spiral was ever sparked (LFG, is also millennial shorthand for "Let's F-cking Go!")

When you add those first two strikes up, and the third doesn't go as planned, you get an immense market failure.

Let's explore strike three: When most of your backstop reserves are in crypto and the broader crypto market is falling, not only is your primary peg mechanism for your stablecoin falling (LUNA) but you now must sell your secondary reserve (bitcoin) which, when sold in amounts as large as $1 billion+, puts immense downward pressure on the entire crypto market. In effect, what was supposed to be a calming release valve became a secondary death spiral as market watchers erroneously mistook a pre-mediated safeguard as a haphazard last ditch effort on Terra's part to prevent a nuclear de-pegging.

In theory, though, it seemed like a good idea! Terra's founder Do Kwon had previously talked about why he was scooping up bitcoin with plans of holding $10 billion -- good enough to be the largest single holder of bitcoin aside from its anonymous founder. By linking the fate of UST to that of bitcoin, Do posited that, "The failure of UST is equivalent to the failure of crypto itself.” Kinda evil genius. Kinda hostage taking. Kinda backfired.

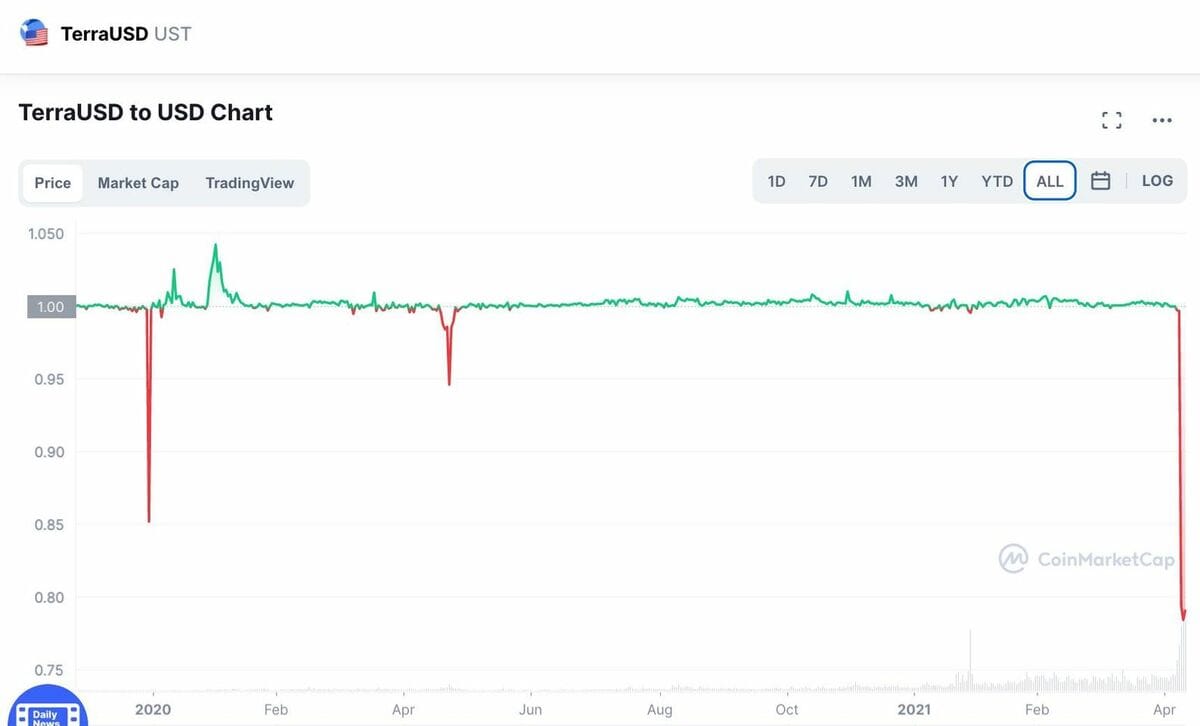

Nonetheless, UST's de-pegging came swiftly and suddenly. UST dropped to 95 cents. Then, to 90 cents. 80. 72 cents. Terra had seen some prior episodes where its peg had looked shaky, including a drop to 85 cents last May -- but never anything as dark as the 68 cents it hit on Monday. People were swapping UST for as low as 63 cents on the dollar for the dollar-backed USDC, which had traded on par with UST just two days prior.

Terra's UST has suffered other episodes of de-pegging, but nothing like the scale of Black Monday (interestingly, the pressure always comes in May.) Source: CoinMarketCap.com

It was a vintage bank run. Even though everything was seemingly working fine (Terra's blockchain swaps and transactions were working fine) people holding UST wanted out at all costs. The price of bitcoin priced in UST on several exchanges skyrocketed to $43,733 (reflecting UST-holders searching for any exit as bitcoin priced in dollars remained at $29,999.)

Meanwhile, deposits on Anchor Protocol continue to tank, dropping from $14 billion on Friday to just $9 billion on Monday, as people rush to take their cash out. Again: Vintage. Bank. Run. Kind of reminded me of the scene in It's a Wonderful Life where George Bailey is trying to beg people not to drain their accounts or sell to the evil Mr. Potter who was all too eager to lowball everyone panicking.

Needless to say, there was a lot of immediate finger pointing as to what triggered the sell off. It could be traced back to someone withdrawing UST from a decentralized finance protocol, then a suspiciously timed $2 billion withdrawal on Anchor. If someone was shorting LUNA, or betting its price would fall, triggering a death spiral would be a very good way to ensure that bet wins. Rumors quickly swirled as to who might be behind such a move, but nothing verified just yet.

In retrospect, the amount of capital needed to accomplish the goal of pressuring Terra into momentary collapse looks laughably small. Terra's Luna Foundation Guard had already publicly revealed their total holdings to be $2 billion. Anyone could see how much UST was held on Anchor. And billionaires have been known to spend much higher amounts targeting much more mature markets of infinitely higher scale.

Think about billionaire George Soros and his $10 billion bet against the British pound back in 1992. He literally broke the Bank of England and earned $1 billion in a day. And that was the Bank of England! Targeting a stablecoin with an $18 billion market cap looks like small potatoes in comparison.

Then again, there are plenty of big money players who want to see Terra recover just as bad. Billionaire Mike Novogratz has long been a Terra supporter, having been involved since LUNA traded near $2 a coin. Jump Crypto, the same team that came to the rescue after a $320 million hack of decentralized finance platform Wormhole, has also been involved in Terra's fundraising.

As the third-largest stablecoin in crypto, Terra's failure would be a huge blow to the space writ large. Of course, other algorithmically-backed stablecoins have died trying to do what Terra had been able to up until Monday. If Terra joins that list of failed stablecoins that had the audacity to try to be completely separate from the traditional banking system, it's worth asking what crypto's really trying to do here?

Are we shooting for the stars? Fitting that we'd land on LUNA. It had ambitious dreams, and they're not over yet. But what comes next could be pivotal in saving the project.

Through my discussions with Terra co-founder Do Kwon, I've learned he's both a ferocious leader and not one to likely go gently into that good night. An injection to re-up the Anchor yield was already being discussed pre-Monday, according to my sources close to Terra's thinking. That would likely prevent further panic UST withdrawals out of Anchor and alleviate some of the downward pressure. But that realistically only matters if the selling pressure on UST abates, or if Terraform Labs (the parent company that has thrown billions into supporting Terra) announces a larger rescue to buy up even more UST. The problem is, they aren't the Fed and don't have an unlimited money printer to turn to.

It took about a week to restore the peg last May. The clock is ticking on what Terra wants to do now. Despite the fact that some bitcoiners seem to be relishing in UST's failure, it's apparent that much more than Terra's fate hangs in the balance. Could an injection or other announcement from Terra be enough to restore the peg? Could it trigger a rebound in LUNA, or is this one too big to battle back from? Let me know in the comments!

Crypto Uncomplicated is a free crypto newsletter distilling all the happenings in the crypto space. Unlock the full experience as a premium subscriber by signing up here.

Disclosure: BTC, LUNA, and UST are all among the author's holdings and it was a very, very bleak Monday for that guy.