- Crypto Uncomplicated

- Posts

- A crypto mimicking one that just evaporated $40 billion is already gaining steam

A crypto mimicking one that just evaporated $40 billion is already gaining steam

If at first you don't succeed...

Just weeks after Terra's ambitious algorithmically backed stablecoin went bust in a stunning collapse, a nearly identical project is picking up the baton even before the dust has even fully settled.

The project is USDD, another algorithmically backed stablecoin that sets out to do exactly what Terra's mission was with UST -- to create a crypto that steadily trades at $1 by collateralizing it with another volatile crypto. In this case, USDD is backed by TRON, an existing blockchain founded by a well-known crypto character in Justin Sun.

But, unlike Terra, USDD is coming out of the gate on the defense since a lot of people have been quick to question the stability of another algo stablecoin right after one led to the largest collapse in crypto's young history. And... you really can't say that's unwarranted. It would be like not questioning the "under new management" sign on a neighborhood KFC that just made everyone sick. Yes, you might have a new manager, but the "chicken" you're selling is still categorically the problem.

In other words, you'd either have to be a really trusting person, or an idiot, not to have you guard up when a project like USDD comes around. And yet -- as I am about to highlight -- there is still a chance to take our learnings from the last exponential rally and collapse to at least try and play this one.

First, let's consider what triggered Terra's massive 13,000% run in 2021. It was, after all, not an accident. Terra's volatile crypto, LUNA, was collateralizing its stablecoin UST. As such, it would be burned as more people put their faith and dollars into UST. The more people adopted UST, the more LUNA would pump. Simple.

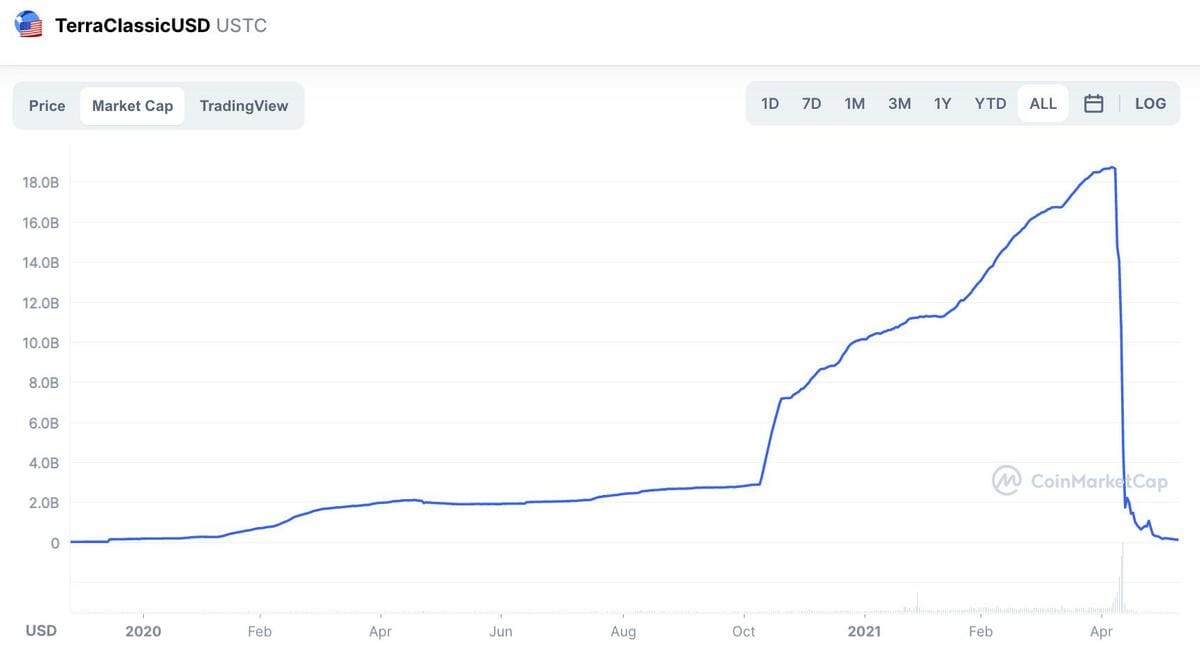

UST's market cap exploded in 2021 (Source: CoinMarketCap.)

To juice adoption, Terra had Anchor savings, a savings protocol that boasted a consistent 20% return on UST deposits. That further encouraged more UST to be created. It was all fine and good until people started panicking about UST dipping below $1 and rushed for the exits.

So far, USDD is following the same exact playbook. As I wrote before, USDD initially was boasting a 30% APY on some platforms. Last week, Kucoin was marketing an introductory 60% interest rate.

You probably won't be surprised when I tell you that it's been working. In fact, despite Terra's collapse being fresh on the minds of everyone in crypto, USDD has miraculously outpaced UST in hitting a market cap north of $600 million.

Now, a big caveat on that is nobody really knows how much of that might just be the team behind it trying to show adoption by buying USDD themselves, or perhaps a limited number of supporter wallets. Where Terra's downfall was so brutal was that the adoption was real -- it attracted more than a million wallets and had a lot of retail adoption.

The same can't necessarily be said for USDD just yet. It's still limited to a few (relatively sketchy) exchanges. And even though Terra's LUNA was never directly tradeable on Coinbase, it was still listed on a few US exchanges like Gemini. And after what happened with Terra, I can't imagine that a lot of exchanges would be rushing to list another algorithmically backed stablecoin -- especially as regulators look to crack down on them.

But, it's at this point in the story where we arrive at the ideological case for it.

Crypto isn't about being regulated. Crypto isn't about asking for permission. The whole reason why Terra took off, in my humble opinion, wasn't because it offered 20% interest, (though that certainly accelerated things) it was because it was delivering on a core crypto tenet: If crypto is really going to challenge the status quo, it can't touch the traditional banking system. It can't run the risk of central banks or regulators just saying "shut it down." As Do Kwon said, "A decentralized economy needs decentralized money."

And crypto is indeed increasingly getting decentralized. In fact, decentralized exchanges (Uniswap, SushiSwap, etc.) actually beat centralized exchanges in on-chain flows over the last year through April, according to Chainalysis.

But Zack, why do people care about censorship resistance, isn't that technically what bitcoin is for?

Yes, and it's functioned well as a store of value. But not so much as a medium of exchange. People aren't really using bitcoin for purchases, nor are they using bitcoin's payment layer (Lightning) in massive numbers, either. UST was promising to be the holy grail.

It makes perfect sense why USDD might try to position itself as that holy grail now. And though it's in Justin Sun's and TRON's interest to say USDD will be different, but we'd all be wise to take heed of the famous quote from investing legend Sir John Templeton: "The four most expensive words in the English language are, 'This time it's different.'"

To be fair, there are things Justin Sun is right about. USDD could do things differently, and it's trying to. Unlike Terra's move to establish a bitcoin reserve of $3 billion after its UST stablecoin had already reached a market cap north of $15 billion, Sun says USDD will start out being over collateralized with other assets. It's starting with a mix of asset-backed stablecoins like USDC and Tether, and bitcoin, with plans to establish a reserve of $10 billion.

TRON's circulating supply has fallen from north of 100 billion to under 94 billion as of June 8, according to Messari stats. (Source: Messari)

It could also be more sustainable with the interest rates that get promoted on USDD. People think Terra's UST could've survived if it only moved sooner to reduce the 20% it was promising depositors. Then again, that's easier said than done when growth is the name of the game in crypto.

Nonetheless, the playbook is pretty clear here. TRON is already being burned as USDD's market cap grows. TRON's supply is down about 5% over the last month, and its price has held up incredibly well this year compared to the rest of the crypto market (it's up 5% on the year vs. BTC's 37% and ETH's 52% respective declines.) That trend should continue. History would also dictate that the party will eventually come to an end. It's just interesting to see how many people who may have been burned in the Terra collapse might try their hand here again.

Buying TRON and waiting to short whenever USDD dips from its peg has to be too easy here, right? Right?

Maybe. Or maybe, this time it's different.

Thanks for supporting Crypto Uncomplicated. Your premium subscription helps make this all possible. If you see other things you want explained, please don't hesitate to hit us up!