- Crypto Uncomplicated

- Posts

- The 7 Biggest Crypto Misconceptions

The 7 Biggest Crypto Misconceptions

Crypto Uncomplicated is a free crypto newsletter distilling all the happenings in the crypto space. Unlock the full experience as a premium subscriber by signing up here.

Legendary author George Orwell once said, "Myths which are believed in tend to become true.”

When it comes to something as convoluted as crypto, there's no shortage of opportunities to spread myths in order to push your own agenda.

But since the only agenda here is to simplify everything about crypto, I figured I'd run through some of the biggest myths about crypto that I see repeated by others in order to break the cycle.

(It's what George Orwell would have wanted.)

"Crypto is Mostly Bitcoin"

"Crypto" and "bitcoin" should never be used interchangeably, but it would have been more forgivable in years past. That's because before other cryptocurrencies like ethereum and its ilk came around, crypto's total market cap really was almost made up entirely by bitcoin's market cap. It was the only show in town, but that's definitely not the case anymore.

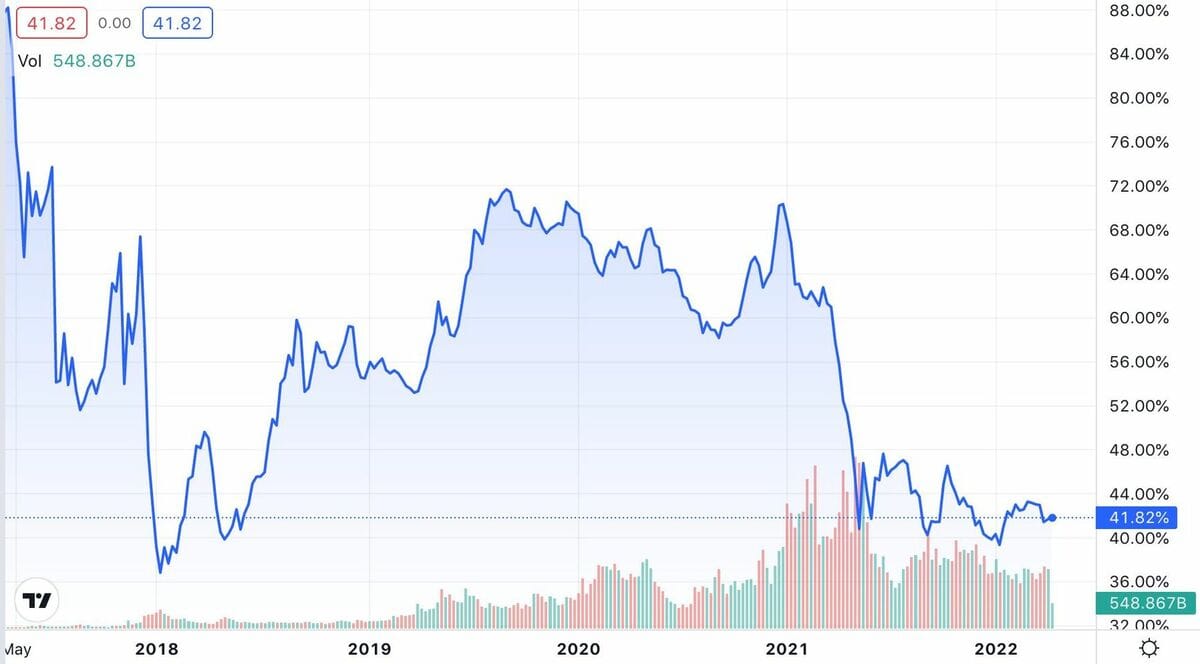

In fact, bitcoin's share of crypto's roughly $2 trillion market cap has fallen considerably, down to just about 40% from north of 80% back in 2018.

"Bitcoin Dominance" or bitcoin's percent share of crypto's total market cap has fallen considerably as other crypto projects have taken off (Source: Trading View.)

2. "Bitcoin Has No Intrinsic Value"

One of the most-often repeated jabs about bitcoin is that it's just pure speculation on something that has no intrinsic value. A more egregious extension of the same thought is comparing bitcoin's run up in price to the Dutch tulip bubble in the 1600's.

The truth is that the market always determines price. That is, something is always worth what someone is willing to pay for it. The same holds true for stocks, bonds, and yes, even bitcoin. Now, to be fair, there is something to be said about the intrinsic value of a share in a company and the fact that it's backed up by that company's assets, revenue, and cash flow. There is intrinsic value there.

But as bitcoin has proven, its network is incredibly effective at securely storing wealth outside of any sovereign nation's currency system. That might seem unnecessary when everything is fine, but as the war in Ukraine has reminded us all, there are unforeseen instances where wealth held in a bank becomes incredibly hard to move. Bitcoin helped an amazing number of Ukrainians escape in a much better position than where they could have been without it.

KYIV, UKRAINE - People line up to withdraw cash from an ATM on February 24 as Russia's invasion intensifies. (Source: Getty Images)

While bitcoin's price in dollars does indeed fluctuate, its intrinsic value as a tool to store value outside of any banking system in a verifiable and transportable way is certainly not "zero."

3. "The US Government Could Just Ban Crypto"

Last September, Fed Chair Jerome Powell made it clear he had no intention of banning cryptocurrencies when he testified in front of the House Financial Services Committee. Other financial government bodies have similarly not made any mention of banning crypto, either.

However, they all have made it clear that regulating the crypto sector needs to happen (which was echoed by President Biden's executive order in March.) But even people in crypto agree that regulating the space would be positive thing. Rules just have to be written in a way that can actually be implemented.

That said, this is where distinguishing between bitcoin and the rest of crypto becomes quite important. The Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have been very clear in labelling bitcoin as a commodity. The SEC, however, has not said much about anything else in crypto not being a security. That leaves the door open for the SEC to potentially label other crypto projects as securities, which would cause problems for exchanges that aren't registered with the SEC to trade securities.

In a future where that happens, it would be quite interesting to see how volumes shift from centralized exchanges like Coinbase and FTX to decentralized exchanges like Thorchain, which don't follow Know Your Customer or Anti-Money Laundering rules.

Either way, an outright "ban" on crypto seems increasingly unlikely.

4. "Crypto is anonymous and mostly used for criminal activity"

Out of all the myths, the idea that crypto is mostly for criminals has to be the most egregious. Case in point, before bitcoin existed, criminals were doing just fine with dollars. Nobody made the case that dollars were somehow bad because some criminals decided to use it.

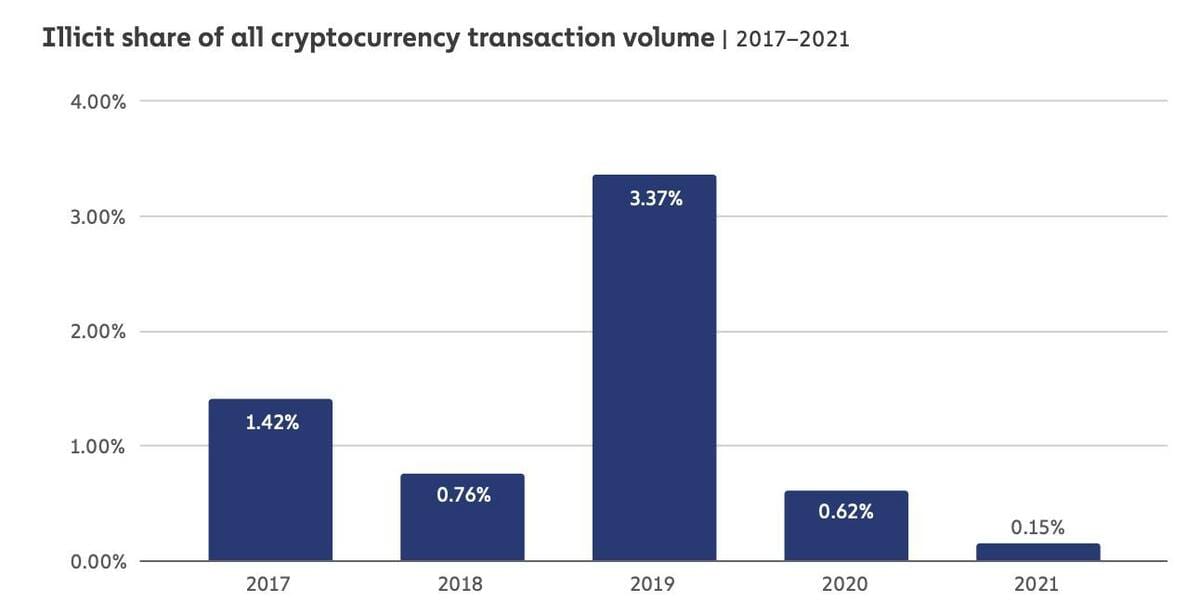

Ok, Zack, but criminals do use crypto. Fair, but how frequent is it? According to a report from Chainalysis, a crypto transaction analysis firm, “Transactions involving illicit addresses represented just 0.15% of cryptocurrency transaction volume in 2021 despite the raw value of illicit transaction volume reaching its highest level ever.”

Nefarious crypto transactions are falling as a percent share of all crypto volumes, according to Chainalysis. (Source: Chainalysis Crypto Crime Report)

So, not very criminal, turns out. Probably for good reason, seeing as most blockchains are publicly viewable and traceable. There are, of course, certain "money mixers" like Tornado Cash that look to scramble funds from one wallet to the next to make it harder for sleuths to track, but even platforms like those have been unscrambled before.

As the recent record $3.6 billion bust by the Department of Justice showed, it's quite possible to unscramble attempts to make transactions anonymous. Even after multiple attempts to allegedly launder 120,000 bitcoin hacked from the Bitfinex exchange, one couple who eventually got caught learned the hard way: crypto and cash can both be bad for criminals.

5. "Crypto is bad for the environment"

As highlighted by a 2017 Newsweek headline that reads, "Bitcoin Mining on Track to Consume All of the World's Energy by 2020," I think it's fair to say there has been a lot of misinformation when it comes to crypto's impact on the environment.

Everything has an energy cost. Banks have an energy cost. YouTube has an energy cost. Bitcoin, ethereum, and other crypto projects have energy costs. Despite also being targeted by a study that grossly overestimated energy use, no one called to ban YouTube when it was reported that the site accounted for nearly 2.5% of the entire globe's energy use.

Pointing out that bitcoin uses energy isn't necessarily a great argument for why it's bad for the environment, when it could potentially also replace the entire carbon footprint of the global banking system (I'm not saying it will, but you know, banks have energy costs, too.)

And yes, while Bitcoin's use of proof-of-work mining, or computers competing to solve complex math equations, does make it a more energy intensive crypto network as compared to its proof-of-stake competitors, bitcoin miners are increasingly turning to areas of cheap, underused energy. For a lot of miners, that has become renewable energy. For others, that has become energy that otherwise might have been wasted or stranded from being used elsewhere on the grid. Either way, most other cryptos are built on a proof-of-stake consensus. Ethereum, for example, is in the process of switching over to proof-of-stake and it's estimated the move will reduce its energy consumption by about 99%.

So yes, crypto, like everything else in life, has an energy cost. As an increasingly self-conscious meat lover, I'll just say sometimes things are worth the energy they consume (steak tastes too good.)

6. "Blockchains are unsafe and easy to hack"

Out of all the myths, this one might be the most nuanced.

There have indeed been a few noteworthy crypto hacks. The largest hacks in the early days were mostly all suffered by centralized exchanges like Mt. Gox or Bitfinex. Since then, other exploits have hit decentralized finance, or DeFi protocols, like Poly Network, which sought to help users trade across disparate blockchains like Ethereum and Bitcoin.

But when it comes to the safety of blockchains themselves, it's worth noting that Bitcoin's network has never been hacked. That's impressive.

The same can't be said for other networks in crypto. When bad actors control more than half of a blockchain's network, they can instigate what's referred to as a 51% attack. It essentially enables the power to double spend and approve false and fraudulent transactions.

So... "unsafe" and "easy to hack" varies widely depending on what blockchain you're talking about.

7. "Crypto is too risky"

While most of crypto remains volatile, the fastest growing piece of crypto is not. Stablecoins, or special cryptocurrencies that are meant to stay pegged to the value of $1, have been exploding recently. More and more people have been converting their dollars into stablecoins to take advantage of the higher than usual interest rates crypto institutions have been paying on them.

Before the SEC brought a record $100 million penalty against crypto lending platform BlockFi for not registering with the agency, BlockFi was paying more than 8% interest on certain stablecoins. Of course, there were risks in that arrangement relative to a traditional savings account. For one, BlockFi's accounts weren't FDIC insured. Second, no one really knew what kind of financial risks BlockFi might run into if their loans went bad.

BlockFi competitor Celsius just announced they, too, would be pulling its interest-earning account access for unaccredited US investors. The pressure from the SEC is starting to limit the options available to savers looking to find yield that is close to 100-times the interest you can earn in a bank. However, the Winklevoss twins-founded Gemini is still holding out for the time being.

Gemini is currently offering 6.9% interest on their GUSD stablecoin, which is fully backed by dollars in an audited account. That 6.9% represents an interest rate that's roughly 100-times higher than the 0.06% average offered by US banks, according to Bankrate.

Hope that clarifies some of the myths in crypto. Feel free to forward to a friend who has also raised any of these myths. Thanks for reading and for signing up to become a premium subscriber.